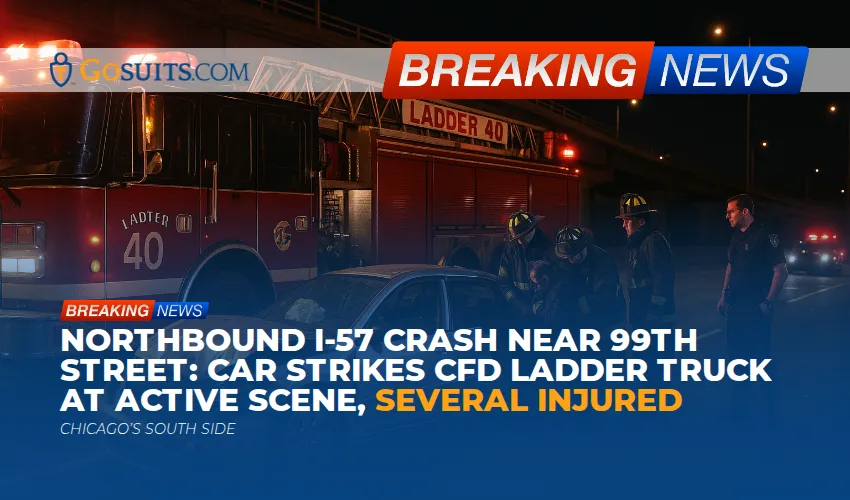

First-Party Commercial Property Damage: Your Business’s Safety Net in Times of Crisis

Commercial property damage can disrupt your business operations, strain your finances, and leave you facing a mountain of uncertainty. Whether it’s a fire, flood, theft, or another catastrophe, the losses go far beyond just physical damage. Your business may face downtime, diminished revenue, and the overwhelming task of rebuilding—all while navigating an insurance process that can feel anything but straightforward. This is where first-party commercial property insurance becomes critical.

What Does a First-Party Commercial Property Claim Cover?

A first-party commercial property claim allows you to seek compensation for damages caused by covered events. These claims typically include coverage for the following:

- Physical Damage to Property

Damage to the structure of your commercial building caused by events such as fires or storms. - Loss or Destruction of Equipment and Inventory

Coverage for damaged or lost equipment, machinery, or stock necessary for your business operations. - Relocation or Temporary Operational Costs

Compensation for expenses incurred from temporarily relocating your business or halting operations due to property damage. - Business Interruption Losses

Provisions to recover lost revenue and additional expenses, such as payroll or utility bills, during the downtime caused by the damage.

For example, if your property sustains significant fire damage, your claim could include coverage for structural repairs, replacement of damaged equipment, and income lost while your business is non-operational. However, the extent of coverage often depends on the specific terms of your policy.

Certain types of damage—such as those caused by floods or earthquakes—may require additional endorsements or separate policies. Knowing what is and isn’t covered under your policy can prevent unpleasant surprises when you file a claim.

Policies also outline different methods for valuing losses, which significantly affect the amount you can recover:

- Replacement Cost Value (RCV): Covers the cost of replacing damaged property with something of similar quality, without factoring in depreciation.

- Actual Cash Value (ACV): Accounts for depreciation, reimbursing you for the current value of the property, which is typically less than the replacement cost.

The Complexities of Navigating First-Party Claims

Filing a first-party claim is rarely as simple as notifying your insurer and waiting for reimbursement. While insurers are obligated to process claims in good faith, many take a more adversarial approach, working to minimize payouts and protect their own bottom line. Disputes often arise over key issues, such as the cause of the damage, the valuation of losses, or whether specific exclusions apply to your policy. These challenges can leave you feeling overwhelmed at a time when your focus should be on restoring your business.

One of the most common hurdles involves coverage disputes. Insurance policies are often filled with complex technical language, exclusions, and conditions that can be difficult to interpret without legal proficiency. For example, a policy may cover water damage caused by a burst pipe but exclude damage caused by flooding. Insurers often use these ambiguities to deny or limit claims, leaving policyholders questioning whether they’re being treated fairly. This is where having an attorney who understands the nuances of policy language becomes critical. An attorney can advocate for your rights so that your claim is properly evaluated and not dismissed based on a misrepresentation of your policy.

Another significant challenge is the burden of proof. Insurers typically require claimants to provide extensive documentation to substantiate their losses, including repair estimates, receipts for damaged equipment, and evidence of lost revenue. The process of gathering and organizing this information is often time-consuming and stressful, particularly when you’re already dealing with the aftermath of property damage. Working with an attorney relieves this burden by ensuring that your claim is meticulously prepared, leaving no room for disputes over incomplete or inconsistent documentation.

Even when insurers approve a claim, disputes over the valuation of damages can arise. For instance, an insurer might undervalue the cost of repairs or depreciate the value of damaged property, offering you far less than what it will actually cost to restore your business. Attorneys with experience in commercial property damage claims know how to challenge these undervaluations, ensuring that the true extent of your losses is accounted for and appropriately compensated.

Business Interruption Losses and Their Impact

For many businesses, the loss of income caused by downtime is just as devastating as physical damage. Business interruption coverage, often included in commercial property policies, is meant to address this. It can cover lost revenue, operating expenses, and even payroll during the period your business is unable to function normally.

However, business interruption claims can be particularly contentious. Insurers often challenge the projected revenue loss or argue that certain expenses are not covered. For example, if your business was already experiencing a downturn before the damage occurred, the insurer may argue that the loss isn’t entirely attributable to the covered event. Calculating these losses requires a thorough understanding of your financial records and often involves working with forensic accountants to substantiate your claim.

Why Legal Support Is Essential

Handling a first-party commercial property damage claim without legal assistance can leave you vulnerable to an array of challenges, from insurer tactics designed to minimize payouts to the overwhelming complexity of policy language and procedures. At Gosuits, we pride ourselves on providing more than just legal representation—we offer personalized support and cutting-edge resources that make a real difference in your case.

Unlike larger firms, where clients are often passed off to case managers or support staff, Gosuits ensures that you work directly with one of our attorneys from start to finish. Your attorney will personally guide you through every step of the claims process, offering tailored advice and consistent communication. Our firm has developed a reputation for excellence and innovation. By combining traditional legal advocacy with proprietary technology, such as our custom-built software utilizing machine learning, we streamline the claims process while maintaining a focus on superior outcomes.

Our legal team is composed of advocates with extensive experience in first-party commercial property damage claims. Having worked on both sides of the table, we bring a balanced perspective and a results-driven strategy to every case. Whether it involves negotiating with insurers, challenging unfair denials, or pursuing litigation, we tailor our approach to your unique needs so your business may receive the compensation it deserves.