Summary

Uber occupational accident insurance is a no-fault, contract-based benefit designed for independent contractors that can pay for medical bills, lost wages, temporary or permanent disability, and death and survivor benefits after a covered on-the-job crash. In California, Proposition 22 requires app-based platforms to provide this coverage when you’re engaged (en route to a pickup or completing a trip or delivery). Eligibility, limits, and exclusions vary by state and policy terms. This guide explains when coverage applies, how to file and appeal a claim, common limits and exclusions, how these benefits interact with third-party claims, and key California, Texas, and Illinois differences.

What will you learn in this guide?

- What Uber occupational accident insurance covers and when it applies

- What rights and benefits California drivers have under Proposition 22

- How Texas and Illinois arrangements can differ

- How to file and appeal occupational accident claims

- What limits and exclusions are common

- How contract benefits interact with personal injury claims

- Key compliance, arbitration, and deadline issues

What is Uber occupational accident insurance, and when does it apply?

Occupational accident insurance is a contract benefit, separate from workers’ compensation, that can pay defined amounts after a covered on-the-job crash regardless of fault. In general, there is no coverage when the app is off. If the app is on but you have not accepted a ride or delivery, occupational accident benefits may be limited or unavailable, though different liability coverages may apply to third-party claims. Full occupational accident benefits are designed to apply once you have accepted a trip or delivery and are en route or on-trip (the engaged period).

California’s framework comes from Proposition 22, which sets minimum standards for these benefits, including at least $1,000,000 in medical expense coverage for on-trip injuries, plus disability and death benefits. Official references are available through California’s Legislative Information site and Ballotpedia’s summary.

What rights and benefits do California drivers have under Proposition 22?

During an engaged trip or delivery in California, drivers are entitled to at least $1,000,000 for reasonable and necessary medical treatment arising from the covered crash, subject to policy terms, utilization review, and any network rules. Temporary disability benefits can replace a defined percentage of average weekly app earnings after a waiting period during physician-certified incapacity and up to specified caps and durations. After you reach maximum medical improvement, permanent disability may be determined using physician impairment ratings and documentation. Death and survivor benefits are provided under Proposition 22 with schedules comparable to California workers’ compensation.

For example, if you are in an active trip and require an ambulance, emergency room care, imaging, surgery, and follow-up, those bills may be submitted up to the medical limit. If your average weekly app earnings were $1,000 and the policy pays a defined percentage after a waiting period, temporary disability could replace a portion of your income during the certified disability period, subject to policy caps.

How do Texas and Illinois arrangements differ?

In Texas and Illinois, occupational accident-style protection is often optional (for example, through Uber’s Driver Injury Protection). These plans are contract benefits, not workers’ compensation, and specifics vary by plan and state. Limits, waiting periods, benefit amounts, and exclusions depend on the plan you select. You can review state-specific information in the Uber app’s insurance section and your policy certificate.

What does Uber occupational accident insurance typically cover, and what is excluded?

During eligible periods, covered items commonly include emergency transport, hospital and surgical care, specialist visits, physical therapy, rehabilitation, prescriptions, and durable medical equipment. Temporary disability benefits may be paid when a physician certifies work restrictions; permanent disability is typically assessed after maximum medical improvement using impairment ratings. Death and survivor benefits may be available for eligible dependents.

Common exclusions include app-off status or not being engaged (in California, full Proposition 22 benefits generally require engagement); intoxication or illegal drug use; racing, criminal activity, or personal errands unrelated to rideshare/delivery; and purely preexisting conditions that were not aggravated by the crash. Network and preauthorization rules can also affect approvals for ongoing care.

How do you file an Uber occupational accident insurance claim?

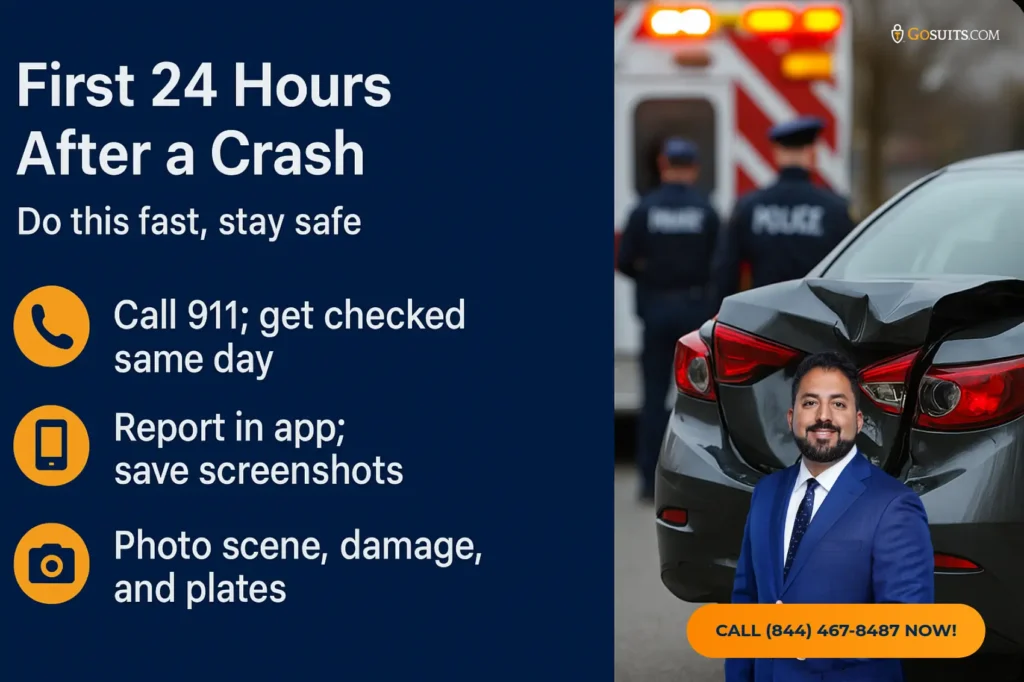

1) Get to safety and call 911 if needed.

2) Report the incident in the Uber app immediately. Save screenshots showing your engagement status (accepted ride/delivery, en route, on-trip).

3) Gather evidence: photos or video of vehicles, scene, and visible injuries; other driver’s information; and witness contacts.

4) Seek same-day medical evaluation and follow the prescribed treatment plan.

5) Start your claim through the in-app claims channel and retain your claim number.

6) Submit trip logs, screenshots, medical records, physician disability notes, and earnings records (from Uber and any other platforms).

7) Follow up in the claims portal to avoid delays and track deadlines.

Note: For non-emergency care, look for network requirements and preauthorization rules in your plan before scheduling ongoing treatment.

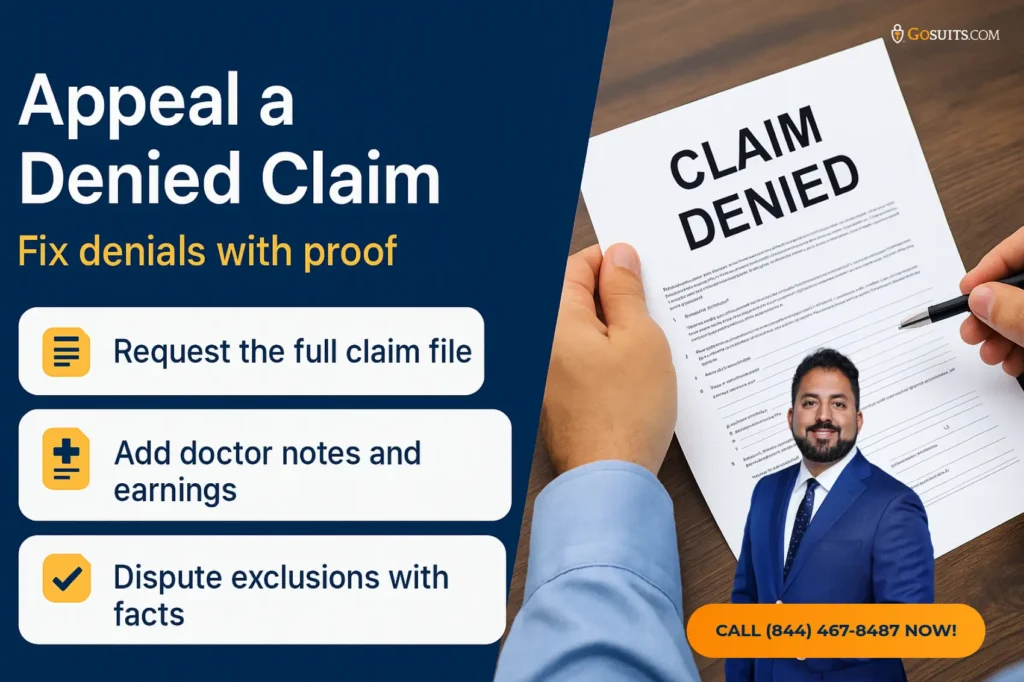

What can you do if your occupational accident claim is denied?

Denials often stem from disputes about whether you were engaged, alleged policy exclusions, causation questions, or insufficient proof of disability. You may request your claim file and submit an internal appeal using the process outlined in the policy. Strengthen the record with treating physician opinions, independent evaluations, and earnings documentation. Where state law allows, you may explore remedies for unreasonable claim delays or other violations. Consider consulting counsel promptly to protect deadlines and evidence.

How do occupational accident benefits interact with other claims?

These contract benefits are separate from third-party bodily injury claims. During covered periods, the plan may pay medical and disability benefits regardless of fault. Independently, you can pursue negligence-based claims against at-fault drivers for pain and suffering, future care, and other damages, as well as uninsured/underinsured motorist claims where applicable. In some cases, product liability or premises liability may be relevant. Preserving both your contract benefits and third-party claims helps maximize lawful recovery.