- What is California Prop 22 and how does it affect Uber and Lyft accident claims?

- How does driver classification under Prop 22 change liability in an Uber accident?

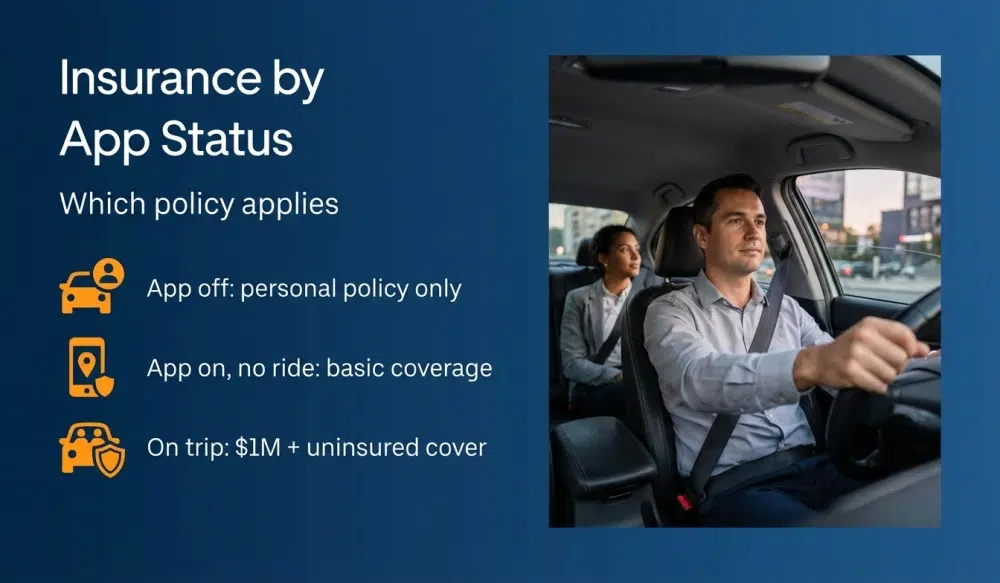

- What rideshare insurance applies by app status for Uber and Lyft in California?

- Who pays in common Uber or Lyft crash claims in CA?

- What steps should you take after a rideshare accident in California?

- How do Prop 22 earnings and benefits influence damages in a personal injury claim?

- How does comparative fault work in California for an Uber or Lyft crash?

- What are the filing deadlines for rideshare injury and wrongful death cases in California?

- Do Uber and Lyft app terms or arbitration clauses affect your civil claim?

- What if the at-fault driver is uninsured or underinsured in an Uber accident?

- What evidence is critical in Uber or Lyft crash claims and how do you get app data?

- How do California courts and local factors affect your case?

- How is a rideshare crash different from a typical car accident in California?

- Why legal help matters for Uber and Lyft crash claims in California?

- How GoSuits supports California rideshare crash clients

What is California Prop 22 and how does it affect Uber and Lyft accident claims?

California voters approved Proposition 22, a statewide initiative that set a distinct legal framework for app based transportation drivers and companies operating in California. In 2023, the California Court of Appeal largely upheld Prop 22 against constitutional challenges, which means its core rules remain in effect for Uber and Lyft drivers in Irvine and across the state [1]. Prop 22 is codified in the California Business and Professions Code sections beginning at 7448 [2].

For people injured in an Uber or a Lyft accident in California, the key takeaways are:

- Driver status Prop 22 affirms that app-based drivers are independent contractors for specified purposes when using a rideshare platform [3].

- Guaranteed earnings and benefits for drivers The law sets an earnings floor during engaged time and provides certain benefits and protections for drivers, such as a health care stipend when eligibility criteria are met. These provisions can inform wage loss calculations in civil cases [4].

- No change to injury victim rights to bring civil claims Prop 22 does not take away your right to pursue negligence claims in civil court for injuries caused by a careless driver, whether that is the rideshare driver or a third party [1][13].

The most immediate impact you will notice is how claims are routed through rideshare insurance policies depending on the driver’s app status, and how the independent contractor framework shapes which entities may be named in your lawsuit or claim.

How does driver classification under Prop 22 change liability in an Uber accident?

Prop 22 continues to classify Uber and Lyft drivers as independent contractors, rather than employees of the platform, while they are using the app for rideshare services as specified by statute [3]. This classification influences how liability is argued and which parties are targeted in a claim, but it does not eliminate civil liability for negligence that injures you.

California negligence law imposes a general duty of care on everyone to act reasonably to avoid harming others, including drivers and companies that design and operate transportation services and systems [13]. In practice for Uber or Lyft crash claims, plaintiffs commonly proceed against:

- The at fault driver Claims alleging negligence in speeding, distraction, unsafe turning, or failure to yield.

- Insurance carriers Claims under applicable liability, uninsured motorist coverage, and underinsured motorist coverage, depending on app status and fault distribution [6][7][8].

- Other negligent third parties Such as other motorists, commercial vehicle owners, or potentially public entities in a road defect scenario where statutory prerequisites are met.

Because drivers are independent contractors, plaintiffs should expect defense arguments contesting vicarious liability against the platform. That said, plaintiffs can still investigate whether company policies, app design choices, or dispatch practices contributed to the crash, and whether any direct negligence or statutory violations can be proven. Each case turns on the facts, the available evidence, and applicable statutes and case law [1][13].

What rideshare insurance applies by app status for Uber and Lyft in California?

California has detailed rideshare insurance rules tied to the driver’s app status. These rules apply in California because state law governs Transportation Network Companies operating here [5][6].

What coverage applies when the app is off?

When the app is off, the driver is using the vehicle for personal reasons. Only the driver’s personal auto policy applies, and rideshare policies do not apply during this period [7].

What coverage applies when the app is on but no ride is accepted?

When the app is on, and the driver is available to receive ride requests, California law requires primary liability coverage of at least 50 thousand dollars for bodily injury per person, 100 thousand dollars per incident, and 30 thousand dollars for property damage. There is also a 200 thousand dollar excess coverage requirement in this period, generally provided by the TNC, subject to policy language [6][7][8].

What coverage applies when the driver is matched to a rider or transporting a rider?

Once a ride is accepted and through the time the rider exits the vehicle, the required coverage increases to a minimum of 1 million dollars in primary commercial liability. California law also addresses uninsured and underinsured motorist coverage during this engaged period for the protection of riders and drivers, often set at 1 million dollars, as reflected in state insurance guidance and regulatory materials [6][7][8].

Coverage sequencing and coordination can be complex with multiple policies in play. A rideshare accident lawyer can sort out which carrier is primary, which is excess, and when personal policies are triggered, particularly when an at-fault third party has limited coverage.

Who pays in common Uber or Lyft crash claims in CA?

Fault and app status drive who pays. Common scenarios include:

- Third party driver is at fault You can claim against the third party’s liability policy. If the at fault policy is insufficient, uninsured or underinsured motorist coverage from the rideshare engaged period policy may fill the gap, depending on app status and policy terms [6][7].

- Rideshare driver is at fault with the rider in the vehicle The 1 million dollar commercial liability is typically primary during an accepted trip or active transport [6][7][8].

- Rideshare driver is at fault while app is on and waiting The 50 thousand and 100 thousand bodily injury minimums apply, plus property damage minimums and an excess layer of 200 thousand dollars as required by statute and regulation [6][7].

- Pedestrian or cyclist struck by an on app rideshare vehicle The same period based rules govern coverage. Documenting app status is crucial.

- Hit and run or uninsured at fault driver UM and UIM can be critical for recovery during engaged periods and sometimes through personal UM policies, depending on the facts [6][7].

These frameworks apply in Irvine and throughout Orange County because they arise from state statutes and regulatory standards for Transportation Network Companies [5][6][8].

What steps should you take after a rideshare accident in California?

Your health and safety come first. Then, begin preserving the proof needed for your civil claim.

- Call 911 and seek medical care Emergency response helps document injuries and scene facts.

- Notify law enforcement California Vehicle Code sets reporting duties for injury or death collisions. Drivers involved must report to the appropriate authority within the specified time frames [10].

- Exchange information and gather evidence Collect driver names, insurance details, plate numbers, and witness contacts. Photograph vehicle positions, damage, traffic signals, and any road hazards.

- Preserve app data Take screenshots showing the trip screen, driver identity, timestamps, pickup and drop off points, and any in app incident reports. Keeping device time settings consistent may help with later authentication.

- Report the crash to the rideshare platform Use the in app safety reporting tools as soon as practical so the platform logs the incident during the correct app status window.

- Comply with accident reporting rules California law requires reports for property damage and injury above certain thresholds, including DMV reporting for qualifying collisions within ten days [9][10].

- Avoid recorded statements before you are ready Claim handlers may seek statements. Consider speaking with a personal injury lawyer first so you understand how statements affect fault determinations and damages.

- Track costs and missed work Keep medical bills, receipts, ride receipts, home care invoices, and evidence of time away from work. This documentation supports your personal injury claim.

How do Prop 22 earnings and benefits influence damages in a personal injury claim?

Prop 22 sets a minimum earnings floor during engaged time measured against a multiple of the applicable minimum wage and a per mile expense component, and it provides a health care stipend for eligible drivers who average a specified amount of engaged time per week [4]. These statutory minimums do not cap your civil damages as an injured person, but they can inform how lost income is analyzed when the injured person is a rideshare driver.

Examples of how these rules can play into damage calculations for Uber and Lyft crash claims include:

- Lost earnings for injured drivers If you drive for rideshare and a crash keeps you off the road, your pre injury earnings records, the Prop 22 guaranteed floor for engaged time, and your documented engaged time patterns can help support lost income claims [4].

- Health care stipend loss If injury related time off reduces engaged hours below the threshold for a stipend, the value of that benefit may be part of the damages analysis with proper proof [4].

- Mileage related expenses Injury downtime can alter expense patterns. While Prop 22 uses an expense component to calculate the earnings floor, your civil claim relies on actual financial losses and reasonable projections supported by records and expert evaluation.

Plaintiffs and defendants will both look closely at app data, tax records, and Prop 22 definitions to evaluate damages. Independent contractor status does not remove the right to pursue full compensatory damages for negligence, subject to proof and California law [3][13].

How does comparative fault work in California for an Uber or Lyft crash?

California follows a comparative fault system. If more than one party contributed to a collision, responsibility can be divided by percentage, and your recovery is reduced by your share of fault. Negligence and causation for each party are determined from the evidence, guided by statutes and case law [13].

In practice, this means a passenger in a rideshare generally has no fault, but a rideshare driver, third-party motorist, pedestrian, or cyclist can share fault depending on traffic rules and conduct. Comparative fault considerations reinforce the importance of collecting objective evidence like traffic camera footage, vehicle event data, and app logs.

What are the filing deadlines for rideshare injury and wrongful death cases in California?

California sets specific statutes of limitation. Missing a deadline can bar your claim, even when liability is clear.

- Two year deadline for injury and wrongful death Most personal injury and wrongful death claims must be filed within two years of the injury or death [11].

- Special rules for public entities If a government entity may be liable, you typically must file a government claim within six months before filing a lawsuit, subject to statutory exceptions [12].

- Shorter internal deadlines Insurance policies and carriers often impose prompt notice provisions. Timely reporting helps preserve coverage rights.

Because some rideshare collisions involve roadway defects, malfunctioning signals, or government vehicles, it is important to identify potential public entity defendants early so the six month claim process is handled properly [12].

Do Uber and Lyft app terms or arbitration clauses affect your civil claim?

Rideshare platforms generally include arbitration provisions in their terms of service for riders and drivers. Whether an injury claim is subject to arbitration depends on the parties, the claim type, and current California and federal arbitration law. Recent appellate decisions address arbitration provisions in rideshare contexts, although many involve employment or wage disputes rather than third-party injury claims [14].

Practical implications for Uber and Lyft crash claims include:

- Forum and procedure If arbitration applies, discovery and timelines can differ from court rules. Strategic choices may change accordingly.

- Third party claims Claims against non signatory third parties, such as another motorist or a vehicle manufacturer, may proceed in court even if other disputes are arbitrable. The case can be split between arbitration and litigation.

Because arbitration law evolves, you should have your terms and claim facts reviewed promptly, especially when multiple defendants and policies are involved.

What if the at-fault driver is uninsured or underinsured in an Uber accident?

California’s rideshare insurance framework anticipates the risk of uninsured or underinsured motorists. During an accepted ride or active transport, UM and UIM coverage is available at substantial limits to protect injured riders and drivers, often set at 1 million dollars in California pursuant to statute and regulatory guidance [6][7][8].

When a crash occurs in the app but waiting period, UM and UIM issues are more nuanced. Policy language and period-specific mandates govern which coverage applies. If you carry personal UM UIM on your own vehicle, those benefits may also come into play as secondary or excess coverage depending on priority rules. This is important for hit-and-run incidents in Orange County, where prompt reporting and documentation support UM claims.

What evidence is critical in Uber or Lyft crash claims and how do you get app data?

In rideshare cases, evidence extends beyond the police report and photos. Key proof often includes:

- App status and trip data Logs showing whether the driver was available, matched, or transporting a rider. The engaged time window can determine which policy is primary [6][7][8].

- Waybills and dispatch records TNCs are regulated in California and must maintain records that can show the timing and nature of the trip, supporting coverage and liability analysis [8].

- Telematics and electronic data Speed, braking, and steering inputs from the involved vehicles, if available.

- Medical documentation Correlating mechanism of injury with medical findings and treatment timelines.

- Employment and earnings records For lost income claims, including Prop 22 engaged time metrics for drivers [4].

Securing the right data early is critical because TNC data retention policies and privacy laws affect access. Preservation letters and targeted subpoenas are common tools used by rideshare accident lawyers to obtain necessary information.

How do California courts and local factors affect your case?

Most California rideshare injury cases are filed in the Orange County Superior Court. Venue and local practices can shape timetables, motion practice, and trial settings [15]. In some cases, defendants may remove a case to federal court if jurisdictional requirements are met. However, the core California TNC insurance and liability laws will still govern substantive issues for California crashes.

Local proof considerations include intersection-specific crash patterns and traffic control timing. Where possible, counsel often seeks traffic signal data, collision histories, and public records. Roadway design, bike infrastructure, and ride pickup zones near destinations like the Spectrum Center can influence how a jury interprets driver behavior.

How is a rideshare crash different from a typical car accident in California?

At first glance, Uber Lyft crash claims look like any other car crash. But there are important differences:

- Multiple layered policies Rideshare insurance interacts with personal auto policies and third party commercial policies, which affects negotiation strategy and settlement leverage [6][7].

- App status driven coverage The exact minute by minute app status can change which insurer is primary, which is excess, and which policy endorsements apply [6][8].

- Electronic records There is often more electronic traceability through trip logs, GPS pings, and dispatch data compared to a typical fender bender.

- Independent contractor framework Arguments about vicarious liability and direct negligence encircle Prop 22 and related statutes [1][3].

Because of these moving parts, people often look to personal injury lawyers who regularly handle Uber and Lyft crash claims for guidance. Teams that routinely manage complex insurance layering issues also often handle other transportation matters like truck accident and motorcycle accident cases, where multiple carriers and policy endorsements can affect outcomes. If you are comparing approaches, look for clear explanations about how the law applies to your claim rather than broad slogans.

Why legal help matters for Uber and Lyft crash claims in California?

Rideshare collisions can involve several insurers, complex app status disputes, comparative fault issues, and strict statutory timelines. If you were hurt in an Uber or a Lyft accident, getting prompt guidance helps you protect evidence, meet deadlines, and identify all potential coverage. Counsel can also coordinate medical documentation and engage with claims representatives so you can focus on recovery.

Key reasons to seek help include:

- Coverage mapping Determining period based rideshare insurance, UM and UIM availability, and personal policy coordination [6][7][8].

- Evidence preservation Securing app data, waybills, and telematics before routine deletion cycles.

- Damages development Building a record for economic and non economic losses, including Prop 22 impacted earnings for drivers [4].

- Deadline management Tracking the two year statute and any government claim filings needed [11][12].

How GoSuits supports California rideshare crash clients

If you are navigating a rideshare injury, you can connect with our team to learn how California’s Transportation Network Company laws work for your situation. GoSuits handles personal injury across California, including Orange County and Irvine. We offer free consultations so you can understand the process, coverage avenues, and your options.

We use a technology driven approach built around our exclusive proprietary software to accelerate case intake, evidence collection, and claim development. While our systems speed up the work, every client has a designated attorney and unfettered access to that attorney. We do not use case managers to stand between you and the lawyer handling your file.

Our attorneys have 30 years of combined experience, with substantial trial experience that helps us prepare every claim for the courtroom from day one. That preparation supports strong negotiation and helps surface the right issues early. Our results include significant recoveries in transportation injury matters, as reflected in our publicly available case summaries.

- See prior work Review selected outcomes on our page at prior cases.

- Meet the team Learn about our trial lawyers at our attorneys.

- About the firm Explore our approach and values at about us.

- What we handle View our full list of practice areas, including rideshare injury, car accident lawyers, motorcycle accident lawyers, truck accident lawyers, wrongful death lawyers, and personal injury lawyers.

Whether your claim involves rideshare insurance disputes, comparative fault, or complex damages, our focus is on clear communication, strong case development, and steady advocacy from intake through resolution.

References and Resources

- Castellanos v. State of California, A163655M certified opinion PDF April 12, 2023 – California Courts

- Business and Professions Code section 7448 Prop 22 definitions and scope – California Legislative Information

- Business and Professions Code section 7451 independent contractor status – California Legislative Information

- Business and Professions Code section 7453 earnings floor and benefits – California Legislative Information

- Public Utilities Code section 5430 Transportation Network Company definitions – California Legislative Information

- Insurance Code section 11580.24 TNC insurance requirements – California Legislative Information

- Rideshare insurance consumer guidance Transportation Network Companies – California Department of Insurance

- Transportation Network Company information insurance and safety – California Public Utilities Commission

- Vehicle Code section 16000 accident reporting to DMV – California Legislative Information

- Vehicle Code section 20008 collision reporting to authorities – California Legislative Information

- Code of Civil Procedure section 335.1 two year statute for injury and death – California Legislative Information

- Government Code section 911.2 claim presentation deadline – California Legislative Information

- Civil Code section 1714 general duty of care – California Legislative Information

- In re Uber Technologies Wage and Hour Cases, A166355 certified opinion PDF – California Courts

- Orange County Superior Court official site filing and local information – Orange County Superior Court