- What is the difference between lost wages and lost earning capacity?

- What is the legal basis for claiming these damages in U.S., Texas, California, and Illinois law?

- How do you prove past lost wages in a personal injury case?

- How do you prove lost earning capacity or diminished earning capacity?

- How are future earnings reduced to present value?

- What medical evidence and impairment ratings matter for lost earning capacity?

- What does vocational expert testimony cover, and why is it used?

- How do calculations differ for self-employed, gig, or cash workers?

- How do car accident claims typically handle lost wages and earning capacity?

- In wrongful death cases, how is lost financial support measured?

- What statute of limitations applies in Texas, California, and Illinois?

- What Texas rules and cases shape lost wages and lost earning capacity claims?

- What California rules and jury instructions address these damages?

- What Illinois rules and cases govern these damages?

- What defenses do defendants and insurers raise against these claims?

- What evidence should you preserve right away to support your claim?

- How do settlements, liens, and taxes affect lost wage or earning capacity awards?

- How can GoSuits help with lost earning capacity and lost wage claims near me in TX, CA, and IL?

- Authoritative sources and references

What is the difference between lost wages and lost earning capacity?

Lost wages are the income you already missed because your injuries kept you from working. Think of it as time you were off the job while you recovered. Lost earning capacity, also called diminished earning capacity or loss of future earnings, is the reduction in your ability to earn income in the future due to the injury. It focuses on how your injuries have changed your long-term economic trajectory, not just the paychecks you already lost.

- Lost wages typically include hourly pay, salary, overtime, shift differentials, tips, and bonuses you would have earned during a period you could not work.

- Lost earning capacity looks forward. It considers your age, education, skills, career path, labor market conditions, and medical limitations to estimate how much less you will likely earn over time because of the injury.

Courts and legal dictionaries describe earning capacity as the power or ability to earn money over time, separate from the exact amount of income at any moment. See the definition of earning capacity and related damages in established legal references such as Dictionary.Law.com and general damages discussions in LII’s Wex on damages.

What is the legal basis for claiming these damages in U.S., Texas, California, and Illinois law?

Both lost wages and lost earning capacity are recognized forms of economic damages in civil personal injury cases.

- General U.S. law: Compensatory damages aim to make an injured person whole, including economic losses such as past and future earnings. See LII: Compensatory damages.

- Federal evidentiary framework: Proof often uses expert testimony, which must meet the reliability standards in Federal Rule of Evidence 702. Discovery of payroll, tax, medical, and vocational records proceeds under Federal Rule of Civil Procedure 26.

- California: Statutes allow recovery for detriment expected to result in the future, a foundation for lost earning capacity. See Cal. Civ. Code § 3283 and general damages provisions at §§ 3281–3282.

- Texas: Texas courts recognize recovery for loss of earning capacity when an injury impairs the ability to work and earn. Texas practice draws a distinction between past lost wages and future earning capacity as different elements of economic damages. Texas statutes also govern time limits for filing and wrongful death damages. See Tex. Civ. Prac. & Rem. Code § 16.003 and Chapter 71 for wrongful death.

- Illinois: Illinois law permits recovery of both past lost wages and diminished earning capacity when supported by evidence that injuries will probably reduce future earnings. Illinois statutes also set the time to sue and govern wrongful death damages. See 735 ILCS 5/13‑202 for limitations and 740 ILCS 180 for wrongful death.

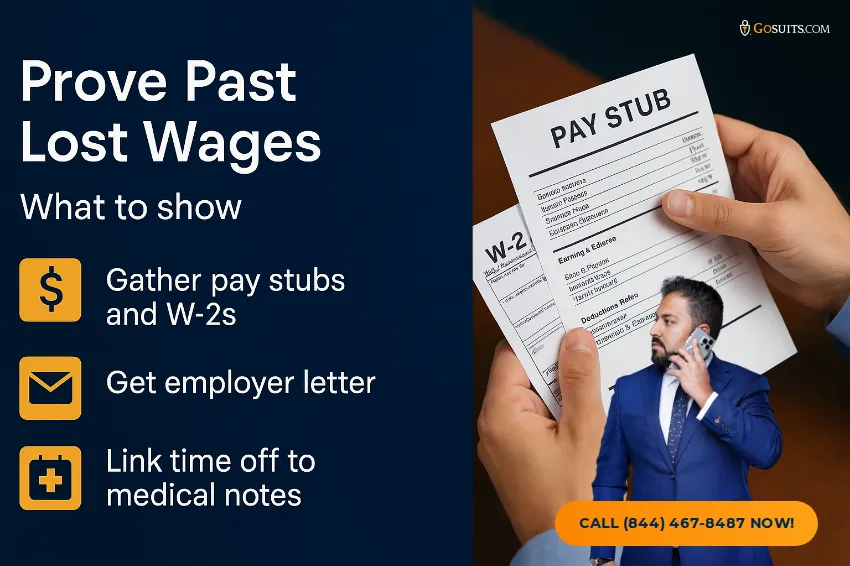

How do you prove past lost wages in a personal injury case?

To prove lost wages, you need credible documentation of what you would have earned and proof that the injury caused the absence from work.

- Income records: Pay stubs, payroll statements, W-2s, tax returns, and direct employer letters. For context on pay records, see IRS guidance on Form W-2.

- Self-employment and gig pay: 1099-NEC and 1099-K forms, invoices, bank deposits, accounting ledgers. See IRS pages for Form 1099-NEC and Form 1099-K.

- Work verification: Employer HR attestations, timekeeping or scheduling data, and benefit records showing PTO used.

- Medical causation: Treating physician notes and restrictions connecting the injury to your time off work.

- Overtime, tips, bonuses: Historical averages documented through payroll and employer records.

Lost wages are usually calculated from the date of injury through the date you returned to work or reached maximum medical improvement, including partial wage loss if you returned with reduced hours.

How do you prove lost earning capacity or diminished earning capacity?

Lost earning capacity focuses on the probability that injuries will reduce your ability to earn over your remaining work-life expectancy. Evidence typically includes:

- Medical limitations: Physician reports on permanent restrictions, functional limitations, pain, and likely progression.

- Vocational assessment: An analysis of transferrable skills, labor market access, ADA accommodations, and realistic job options, often summarized by a vocational expert.

- Economic analysis: An economist quantifies the delta between pre-injury and post-injury expected earnings, applying work-life tables and discounting to present value.

- Work history: Education, certifications, promotions, career trajectory, and planned training that are now impacted.

- Objective data: Regional wage surveys, BLS occupational wages, and unemployment rates in your locality to ground projections.

Courts accept reasonable probability, not certainty, especially for future losses. California’s Civil Code explicitly permits recovery for detriment that is certain to result in the future, supporting these projections in that state Cal. Civ. Code § 3283. Texas and Illinois practice similarly allow earning capacity recovery upon competent proof. Expert testimony must be reliable and relevant under FRE 702.

How are future earnings reduced to present value?

Courts generally require that future economic losses be converted into a present-value lump sum. The U.S. Supreme Court discusses methods for discounting future earnings, including real interest rate approaches, in Jones & Laughlin Steel v. Pfeifer 462 U.S. 523, 536–47. Economists often:

- Project base earnings: Use recent wages, career trajectory, and industry data.

- Adjust for growth: Estimate real wage growth separate from inflation.

- Apply work-life expectancy: Account for probability of labor force participation, retirement, and mortality.

- Discount to present value: Use a real discount rate, sometimes offsetting wage growth against discount rates per Pfeifer’s guidance.

The specific rate and method can vary by jurisdiction and expert evidence.

What medical evidence and impairment ratings matter for lost earning capacity?

Medical proof ties your limitations to your injury and establishes permanence or duration:

- Diagnosis and treatment: Imaging, operative reports, and therapy records that demonstrate functional loss.

- Restrictions: Physician-imposed limits on lifting, reaching, sitting, standing, repetitive motions, or cognitive functions.

- Prognosis: Whether residual symptoms, flare-ups, or degenerative progression are expected.

- Impairment ratings: Where available, formal impairment ratings can support the degree of functional loss. These ratings inform, but do not control, an individual’s actual ability to work.

Medical opinions must be specific. For future earning capacity, courts look for a reasonable medical probability that limitations will affect your ability to work, supported by consistent records.

What does vocational expert testimony cover, and why is it used?

Vocational experts analyze how an injury changes someone’s access to jobs and wage levels. They evaluate transferable skills, required accommodations, labor market data, and realistic job placement. While often discussed in the disability context by agencies such as the Social Security Administration, where vocational experts explain job availability and skill transferability SSA: Vocational Experts, civil courts also hear vocational testimony to assess diminished earning capacity. Under FRE 702, the court evaluates whether the expert’s methods are reliable and applied properly to the facts.

How do calculations differ for self-employed, gig, or cash workers?

For self-employed or gig workers, the question is what you would have earned but for the injury, supported by objectively verifiable records.

- Revenue and expenses: Tax returns, 1099-NEC and 1099-K forms, bank statements, and bookkeeping show net lost profits, not just gross receipts.

- Seasonality and trends: Year-over-year comparisons and booking calendars can establish expected earnings during the disability period.

- Substitute labor: If you hired others to keep the business running, those costs and continued revenue must be separated to avoid double counting.

- Tips and cash: Show consistent deposits, point-of-sale reports, and past tax filings to corroborate cash income.

For future capacity, vocational and economic experts consider the business model, client retention, and market conditions in your city, whether in Houston, Dallas, Austin, San Antonio, Fort Worth, El Paso, Los Angeles, San Diego, San Jose, San Francisco, Sacramento, Chicago, Aurora, Naperville, or Springfield.

How do car accident claims typically handle lost wages and earning capacity?

Traffic crashes are a leading source of serious injuries that interrupt work. National data reflect the scale of the problem. In 2022, U.S. motor-vehicle crash fatalities remained at historically high levels, with more than forty thousand deaths nationwide, according to federal transportation data NHTSA. Beyond fatalities, nonfatal injuries lead to missed work and reduced earnings. Employers also report millions of nonfatal workplace injuries and illnesses annually that can compound wage loss when crashes happen on the job; for example, private industry employers reported 2.8 million nonfatal injuries and illnesses in 2022 BLS OSH News Release.

In auto claims, adjusters commonly ask for wage documentation, medical work notes, and confirmation from employers. For future earning capacity, insurers scrutinize vocational and medical opinions. Litigation may be necessary when an insurer disputes causation or the extent of economic loss.

In wrongful death cases, how is lost financial support measured?

Wrongful death statutes allow certain family members to recover the decedent’s lost financial support. This is related to, but distinct from, the decedent’s own lost earnings claim that could be pursued by an estate in some jurisdictions.

- Texas: Wrongful death beneficiaries may recover loss of financial support and inheritance under the Texas Wrongful Death Act.

- California: Eligible survivors may recover the decedent’s lost financial support under Cal. Code Civ. Proc. § 377.60, with future losses awarded when reasonably certain Cal. Civ. Code § 3283.

- Illinois: The Wrongful Death Act allows recovery for loss of support and other pecuniary injuries to next of kin 740 ILCS 180.

Economists typically project the decedent’s expected earnings, taxes, personal consumption, and then discount to present value to estimate the net support the family has lost.

What statute of limitations applies in Texas, California, and Illinois?

Filing deadlines are critical. Missing the deadline can bar your claim.

- Texas: Generally two years for personal injury Tex. Civ. Prac. & Rem. Code § 16.003. Wrongful death is also subject to a two-year period under Chapter 16, with certain exceptions.

- California: Two years for personal injury Cal. Code Civ. Proc. § 335.1. Different deadlines may apply to government claims.

- Illinois: Two years for actions for damages for injury to the person 735 ILCS 5/13‑202.

Some claims require special notices or shorter deadlines, especially when public entities are involved. Act promptly to protect your rights in TX, CA, and IL.

What Texas rules and cases shape lost wages and lost earning capacity claims?

Texas practice distinguishes between past lost wages and future loss of earning capacity. Courts allow recovery for diminished earning capacity when an injury likely reduces the person’s ability to earn money in the future. Texas caselaw emphasizes that earning capacity focuses on a person’s ability to earn, not just prior earnings, and juries may consider age, health, occupation, skills, and the nature of the injury. Discovery and admissibility follow the Texas Rules of Evidence and Civil Procedure, which are aligned in many respects with federal standards. For statewide court rules and resources, see the Texas Judicial Branch rules portal txcourts.gov and the State Law Library’s rule guides guides.sll.texas.gov.

Local considerations: juries in Houston, Dallas, Austin, San Antonio, Fort Worth, and El Paso frequently hear vocational and economic expert testimony on earning capacity. Documentation of wages, medical restrictions, and realistic job alternatives in the local economy strengthens claims.

What California rules and jury instructions address these damages?

California law provides a clear statutory basis for future damages, including earning capacity. Cal. Civ. Code § 3283 authorizes compensation for detriment that is certain to result in the future. California civil jury instructions distinguish between past lost earnings and loss of future earning capacity, requiring substantial evidence of the amount and duration of future losses. Courts look for reasonable certainty grounded in medical proof and labor market data. California venues such as Los Angeles, San Diego, San Jose, San Francisco, and Sacramento often require detailed vocational and economic analyses and, where appropriate, a present-value calculation consistent with California practice.

What Illinois rules and cases govern these damages?

Illinois recognizes both past lost wages and diminished earning capacity. Plaintiffs must show that injuries are reasonably certain to cause a reduction in future earnings, supported by medical testimony and vocational-economic analysis. The Illinois Wrongful Death Act also allows next of kin to recover for the loss of financial support. Limitations rules are strictly applied under 735 ILCS 5/13‑202, so prompt filing is essential. In Chicago, Aurora, Naperville, and Springfield, courts expect detailed documentation and reliable expert methods when projecting future losses.

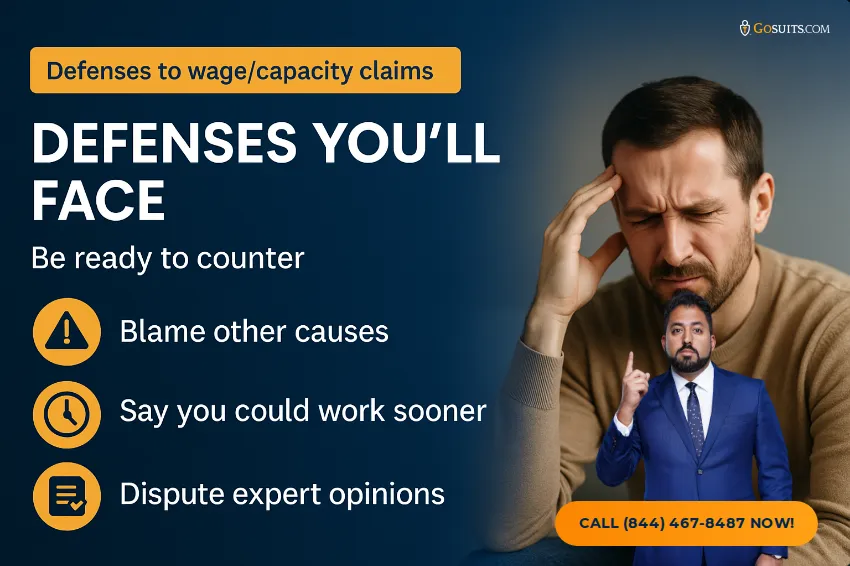

What defenses do defendants and insurers raise against these claims?

- Causation challenges: Arguing that wage loss stems from preexisting conditions or unrelated economic factors.

- Failure to mitigate: Claiming you could have returned to work earlier or found comparable employment with reasonable effort.

- Speculative projections: Attacking vocational or economic opinions as too uncertain or unsupported by local data.

- Inadequate records: Pointing to gaps in payroll, tax, or medical documentation.

- Alternate earnings: Offsetting with income earned post-injury or suitable alternative jobs.

Defendants may move to exclude unreliable expert opinions under standards like FRE 702, so methodologically sound reports are critical.

What evidence should you preserve right away to support your claim?

- Income proof: Pay stubs, W-2s, 1099s, tax returns, bank statements, invoices.

- Employer communications: HR emails, time-off approvals, schedules, and payroll summaries.

- Medical records: Work restrictions, physician notes, imaging reports, therapy logs.

- Job search efforts: Applications, interview logs, and rejection notices to demonstrate mitigation efforts.

- Business records: For self-employed, ledgers, contracts, client emails, CRM exports.

- Digital evidence: Preserve relevant electronic records. In federal practice, parties must address electronically stored information in discovery plans under FRCP 26, and spoliation of ESI carries consequences under FRCP 37(e).

How do settlements, liens, and taxes affect lost wage or earning capacity awards?

- Liens and subrogation: Health insurers, government programs, or workers’ compensation carriers may assert reimbursement rights that impact your net recovery. Review plan and statutory lien rights early.

- Tax treatment: Under 26 U.S.C. § 104(a)(2), damages for personal physical injuries or physical sickness are generally excluded from gross income, with exceptions for interest and punitive damages. See 26 U.S.C. § 104(a)(2) and IRS Publication 4345 on settlement taxability IRS Pub. 4345.

- Allocation: Settlement agreements sometimes allocate amounts among wage loss, medical expenses, and general damages. Careful drafting helps avoid disputes over withholdings or lien satisfaction.

Always address these issues before finalizing a settlement to avoid avoidable delays in Houston, Dallas, Austin, San Antonio, Fort Worth, El Paso, Los Angeles, San Diego, San Jose, San Francisco, Sacramento, Chicago, Aurora, Naperville, Springfield, and surrounding areas.

How can GoSuits help with lost earning capacity and lost wage claims near me in TX, CA, and IL?

You deserve clear answers and a steady hand after a serious injury. When income stops or your career path changes, the stakes are high. We focus on building detailed, evidence-based economic claims for clients throughout Texas, California, and Illinois, including Houston, Dallas, Austin, San Antonio, Fort Worth, El Paso, Los Angeles, San Diego, San Jose, San Francisco, Sacramento, Chicago, Aurora, Naperville, and Springfield.

- Availability and communication: We are available 24/7 with an immediate free consultation any time you contact us. You can reach an attorney or trained staff member at all of our offices day or night, including weekends and holidays. We provide multilingual service, with 24/7 Spanish and Farsi speakers, and access to additional languages. Expect frequent updates, rapid responses to questions, and proactive scheduling to fit your life and recovery.

- Fee policies and cost transparency: We offer a No win, No Attorney Fees policy. Read more: No win, No Attorney Fees. There are no hidden administrative fees. All case costs and reimbursement practices are discussed up front in writing, so you know how costs are handled through settlement or verdict.

- How our tools and workflow help your claim: We built proprietary personal injury software used only inside our firm. It accelerates investigation, organizes wage and tax records, compares BLS wage data, and tracks medical restrictions. The platform streamlines demand preparation, negotiation, filing, and discovery, helping us analyze lost wages and diminished earning capacity faster and with fewer errors. We are a law firm that looks ahead of the curve to beat insurers at their own data games.

- Experience and track record: Our team brings 30 years of combined experience. We have litigated more than 1,000 cases, with settlement and verdict results published here: GoSuits prior cases. In complex matters such as product liability, 18-wheeler crashes, brain injuries, and spinal injuries, we retain qualified experts within the state to testify and help establish liability and damages. We litigate severe injury and complex cases across TX, CA, and IL.

- Awards and recognitions:

- #1 Settlements and verdicts across multiple U.S. counties according to TopVerdict.

- Top 100 Settlement in Texas.

- Sean Chalaki recognized in Top 40 Under 40 by National Trial Lawyers.

- Recognized by Best Lawyers in 2023, 2024, and 2025.

- Selected to Super Lawyers since 2021.

- Client-focused, not a volume firm: We limit caseloads so we can dig into the details that move the needle on economic damages. That means thoroughly documenting your pre-injury trajectory, capturing every verifiable dollar of wage loss, and presenting clear vocational and economic analyses that are ready for court.

- Immediate steps we can take:

- Collect payroll, tax, and employer verification within days.

- Coordinate with your physicians to obtain detailed functional restrictions and prognosis.

- Engage vocational and economic consultants early where helpful to your case.

- Develop a mitigation plan and document your job search or accommodation attempts.

- Protect your case from common insurer tactics that target wage-loss claims.

- Local presence: We maintain staffed offices across Texas, California, and Illinois, with attorneys and support teams available 24/7. We can meet in person or virtually on short notice to accommodate medical limitations, whether you are in a major metro or a nearby community.

Our goal is to move your case forward quickly and carefully, with clear communication and rigor in every calculation. If you or a loved one suffered a serious injury that threatens future earnings, a free, no-obligation consultation can help you understand next steps and timelines.

Authoritative sources and references

- Legal definitions and damages overview: LII Wex: Damages, LII Wex: Compensatory Damages, Dictionary.Law.com.

- Expert testimony and discovery: Fed. R. Evid. 702, Fed. R. Civ. P. 26, Fed. R. Civ. P. 37(e).

- Present value guidance: Jones & Laughlin Steel v. Pfeifer, 462 U.S. 523.

- California damages statutes: Cal. Civ. Code § 3283, Cal. Code Civ. Proc. § 335.1, Cal. Code Civ. Proc. § 377.60.

- Texas statutes and court resources: Tex. Civ. Prac. & Rem. Code § 16.003, Tex. Civ. Prac. & Rem. Code ch. 71, Texas Court Rules and Standards, Texas State Law Library: Court Rules.

- Illinois statutes: 735 ILCS 5/13‑202, 740 ILCS 180.

- Vocational experts: SSA: What is a Vocational Expert?.

- Income documentation: IRS: Understanding Your Form W-2, IRS: About Form 1099-NEC, IRS: About Form 1099-K.

- Tax treatment of settlements: 26 U.S.C. § 104(a)(2), IRS Publication 4345.

- Injury and crash context: BLS: Employer-Reported Workplace Injuries and Illnesses, 2022, NHTSA: Traffic Safety Data.