- Dealing with the aftermath of a car accident is never simple. Insurance paperwork, calls with adjusters, and questions about evidence preservation can quickly overwhelm even the most organized driver. When the insurer is GEICO, the process may appear straightforward thanks to its online tools and mobile app. Yet for claimants in California, Texas, and Illinois, there are important legal and procedural differences that can change how your claim is filed, how it is handled, and how it is ultimately resolved.

What is GEICO?

GEICO, or the Government Employees Insurance Company, is one of the largest auto insurers in the United States. It is a subsidiary of Berkshire Hathaway, which means it has the financial backing of one of the world’s largest holding companies. While GEICO began in 1936 serving government employees and military families, it now insures millions of policyholders nationwide.

For claimants in California, Texas, and Illinois, GEICO is a centralized system with local presence. Unlike smaller Texas-only insurers, GEICO directly manages its claims rather than outsourcing them to third-party administrators. Claims are generally routed through a centralized system accessible by phone, app, or online portal, but local adjusters or inspection shops in each state carry out the work.

GEICO is known for its national advertising campaigns and promises of quick claim resolution. However, as with any insurer, it uses trained adjusters and internal guidelines to minimize payout costs.

How GEICO Handles Your Claim

Once a claim is filed, GEICO generates a claim number and assigns it to an adjuster. The adjuster becomes the main point of contact, although GEICO also maintains an online portal where updates and documents can be tracked.

Vehicle Damage

- GEICO will either schedule a mobile inspection or direct you to a GEICO Auto Repair Xpress® location.

- These repair facilities provide same-day inspections and repairs, with GEICO’s lifetime repair guarantee.

- You are not required to use a GEICO partner shop; you may select your own repair facility.

Bodily Injury

- Bodily injury claims are handled separately and may involve a different adjuster.

- GEICO typically requires medical records, billing statements, and sometimes signed authorizations.

- Adjusters may apply “usual and customary” reductions to medical charges, paying less than the billed amount.

Settlement Timelines

- GEICO generally contacts claimants within 24–48 hours of filing.

- Vehicle inspections are often scheduled within a week.

- Injury claims may take longer, as GEICO may wait until treatment concludes before discussing a settlement.

Common Issues

- Quick settlements: GEICO may offer fast, low settlements to close files cheaply.

- Recorded statements: Adjusters often request them, but you are not legally required to give one unless compelled.

- Comparative fault arguments: GEICO may assign you partial fault, lowering the payout.

- GEICO will either schedule a mobile inspection or direct you to a GEICO Auto Repair Xpress® location.

State-Specific Claims Guidance

California: California is a comparative negligence state, so even a small percentage of fault can reduce recovery. Proposition 213 further restricts non-economic damages for uninsured drivers. Claims involving UM/UIM coverage require careful medical documentation.

Texas: Texas law requires insurers to acknowledge claims within 15 days. Filing digitally creates a record of the claim’s timeline. PIP and MedPay coverage, if included, should be specifically referenced. See Texas DOI.

Illinois: Illinois is a fault-based state. Adjusters may attempt to reduce liability through comparative fault. Recorded statement requests are common but not required unless mandated. See Illinois DOI.

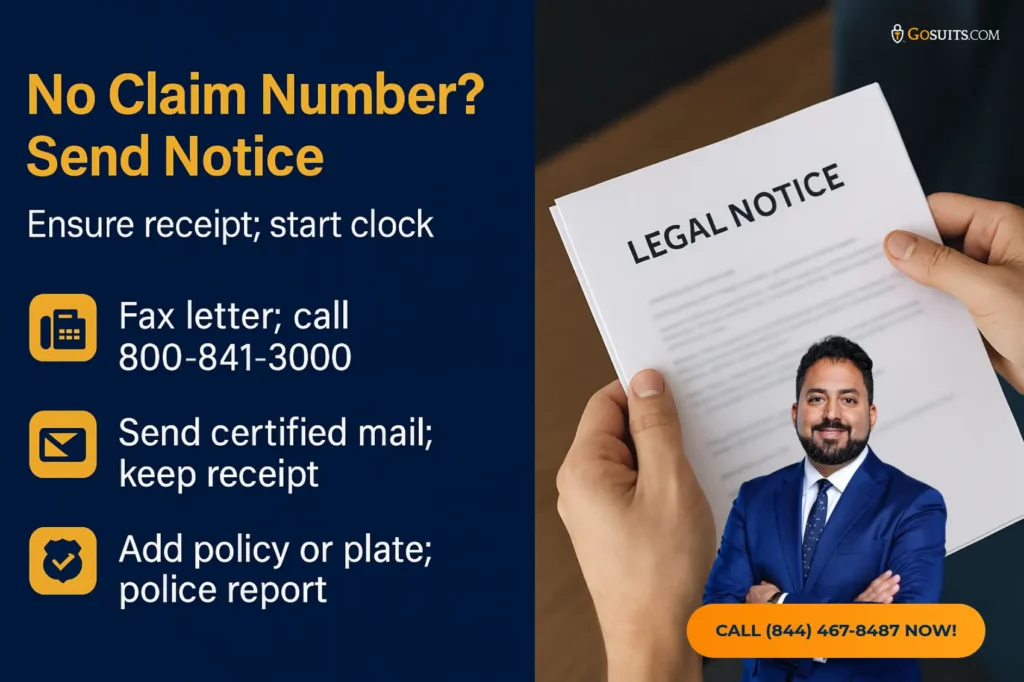

How To Submit Legal Correspondence To GEICO Without a Claim Number

When an attorney or injured party must send a letter of representation or spoliation notice before a claim number is established, GEICO provides options:

- Fax: Fax letters to GEICO’s legal intake lines for timestamped proof of delivery. Attorneys frequently rely on this for evidence of notice. To obtain the appropriate fax number, contact a GEICO claims or service agent by calling (800) 841-3000 or emailing [email protected], as fax numbers are typically provided directly by an agent.

- Certified Mail: Before sending important documents, always check your policy or bill for a specific address, as it is often the fastest route to the right department. For general or critical correspondence, use the addresses below.

For any time-sensitive or legal documents (like proof of insurance cancellation or a formal complaint), always send your mail via USPS Certified Mail with Return Receipt Requested. This provides you with a legal record of delivery.

For most policy-related mail:

GEICO

P.O. Box 803285

Dallas, TX 75380-3285

For official or critical correspondence:

GEICO Headquarters

5260 Western Avenue

Chevy Chase, MD 20815

- Email Portal: For existing claims, GEICO allows document upload through its Claim Center. For new claims without a number, attorneys should still use fax or mail to ensure receipt.

Why It Matters

Under state laws (e.g., Texas Insurance Code), once an insurer receives notice of a potential claim, they must acknowledge it within a statutory timeline. Sending letters before a claim number is assigned places responsibility on GEICO to route the notice to the correct department and assign an adjuster.

What to Include

- Insured’s name and policy number (if known).

- Date, time, and location of accident.

- Police report number.

- Vehicle description and license plate.

- Representation statement and request for preservation of evidence.

This level of detail ensures that even without a claim number, GEICO can match your correspondence to the policy and initiate processing.

Step-by-Step Process On How To File A Claim With GEICO

GEICO is one of the largest auto insurers in the country, with an extensive digital platform and nationwide call centers. Its size makes filing relatively straightforward, but it can also mean delays, complex claim evaluations, and adjusters who are not always familiar with local rules. Before starting your claim, it is wise to consult with GoSuits for a free initial case review. Taking this step ahead of filing helps you understand the full range of your rights and prevents you from facing the process unprepared. Once you have done that, here is how the GEICO claims process generally works.

Step 1: Filing the Claim

Submit online, via app, or by calling 1-800-841-3000. Provide all key details: parties involved, accident date, and location. Filing digitally creates a timestamp and claim tracking record.

Step 2: Claim Number Assignment

Within 24–48 hours, you should receive a claim number. Use it in all correspondence, including legal letters, emails, and phone calls.

Step 3: Adjuster Contact

An adjuster is assigned to your case. Expect calls requesting details, documents, and possibly a recorded statement. Proceed cautiously with recorded statements.

Step 4: Vehicle Inspection and Repair

GEICO schedules an inspection, either at a Repair Xpress® shop, through a mobile adjuster, or at a shop of your choice. You will receive an estimate and payment options.

Step 5: Medical Documentation

For injury claims, GEICO requires treatment records and billing statements. They may delay settlement until treatment concludes, but interim discussions are possible.

Step 6: Settlement Offer

GEICO issues an initial offer. Review carefully. It may undervalue damages, exclude pain and suffering, or reduce medical bills.

Step 7: Negotiation or Litigation

If the settlement is inadequate, further negotiation or litigation may be required. Attorneys often resubmit documentation, demand letters, or pursue court action if GEICO resists fair settlement.

Best Practices When Filing A Claim With GEICO

- Do not rush into quick settlements.

- Refuse recorded statements unless required.

- Preserve evidence early through letters of representation.

- Emphasize state-specific protections: California’s comparative fault laws, Texas’s prompt acknowledgment deadlines, and Illinois’s fault-based rules.

Schedule A Free Consultation With GoSuits

When an accident interrupts your life, you deserve a claims process that is clear, timely, and handled with care. At GoSuits, we turn the steps in this guide into real progress by pairing attorney leadership with modern systems that keep your case moving.

Our team brings 30 years of combined experience, and we have recovered millions for thousands of clients across California, Texas, and Illinois. Clients work directly with our attorneys from day one, with no case managers involved, and our proprietary technology streamlines every stage while giving you secure, direct access to your case file at any time. This is why our Google Business Profile reflects strong, consistent reviews from people who value transparency, communication, and results. If you are ready to file a GEICO accident claim or want a second opinion on a stalled one, GoSuits is here to help. Call us at (844) 467-8487 today.

Top Questions People Ask (FAQ Section)

How long does a GEICO claim take to settle?

The timeline for settling a GEICO claim varies depending on the complexity of the case. Minor property damage claims may resolve more quickly, while bodily injury claims involving significant medical treatment can take longer. Factors such as the extent of your injuries, the availability of evidence, and GEICO’s willingness to negotiate can all influence the timeline.

What if GEICO denies my claim?

If GEICO denies your claim, don’t lose hope. You have the right to appeal the decision. Gather any additional evidence that supports your claim and consult with an attorney. A GoSuits lawyer can review the denial, identify any errors, and negotiate with GEICO on your behalf. If necessary, they can file a lawsuit to protect your rights.

What is GEICO subrogation, and how does it affect me?

GEICO subrogation is the process by which GEICO seeks to recover the money they paid to you from the at-fault party’s insurance company. If you’ve already settled your claim with GEICO, you may need to cooperate with their subrogation efforts. An attorney can advise you on your obligations and protect your interests during this process.

Do I have to give GEICO a recorded statement?

While it’s common for GEICO to request a GEICO recorded statement, you are not legally obligated to provide one. Before giving a statement, it’s wise to consult with an attorney. They can advise you on what information to share and how to avoid making statements that could harm your claim. Protecting yourself from saying something that impacts your GEICO settlement offer is important.

What should I do if the GEICO adjuster is not being fair?

If you believe the GEICO adjuster is not being fair or is undervaluing your claim, document all communication and consult with an attorney immediately. A GoSuits attorney can communicate with the adjuster on your behalf, negotiate for a fair settlement, and, if necessary, file a lawsuit to protect your rights. Having an attorney advocate for you can level the playing field.