- What does “broker negligence” mean after a truck crash?

- How is a freight broker different from a motor carrier or freight forwarder?

- Can you sue the trucking broker for negligence?

- Does federal law preempt broker-negligence claims?

- How have courts in California, Texas, and Illinois treated broker liability?

- When can a broker be vicariously liable for a trucker’s negligence?

- Which federal safety rules and records matter in a broker case?

- What records should be preserved and how do you send a preservation letter?

- What evidence proves or defeats broker negligence?

- How do statutes of limitations work in TX, CA, and IL for broker claims?

- How do damages and fault allocation work in these cases?

- Can punitive damages apply against a broker?

- What steps should you take after a crash involving a brokered load?

- How do contingency fee arrangements and costs typically work?

- What are quick answers to common broker negligence questions?

- How does GoSuits help truck crash victims and families?

- References and resources

What does “broker negligence” mean after a truck crash?

If you were hurt in a crash with a tractor-trailer, you may wonder whether you can sue the company that arranged the shipment, not just the truck driver or motor carrier. In many shipments, a freight broker connects a shipper with a trucking company. Broker negligence is a civil claim that a broker failed to act with reasonable care when choosing or overseeing a motor carrier for your load, and that this failure contributed to your injuries. Courts often call this negligent hiring, negligent selection, or negligent entrustment by a broker.

Why does this matter? Serious truck crashes are common. According to the Federal Motor Carrier Safety Administration’s Large Truck and Bus Crash Facts, in 2021, there were about 5,700 large trucks involved in fatal crashes and approximately 117,300 involved in injury crashes nationwide. Many of these crashes occurred on interstates and major corridors that connect Texas, California, and Illinois to the rest of the country. See FMCSA Large Truck and Bus Crash Facts 2021 for detailed national statistics.

Holding every responsible party accountable can make a difference, both for your recovery and for safety on the road. In Houston, Dallas, Austin, San Antonio, Los Angeles, San Diego, San Jose, San Francisco, Chicago, Naperville, and Springfield, many shipments are brokered every day. Whether you can bring a claim against the broker depends on the facts and the law in your state and federal circuit.

How is a freight broker different from a motor carrier or freight forwarder?

Understanding the roles helps clarify who may be liable:

- Broker: Under federal law, a broker is a person or company that arranges transportation by motor carrier for compensation, but does not provide the actual transportation. See 49 U.S.C. § 131022) and 49 CFR § 371.2. Brokers must be registered with the FMCSA. See 49 U.S.C. § 13904.

- Motor carrier: A motor carrier provides transportation by commercial motor vehicle. See 49 U.S.C. § 1310214); 49 CFR § 390.5T. Carriers operate the trucks, employ or contract with drivers, and are directly subject to FMCSA safety rules.

- Freight forwarder: A freight forwarder may assemble and consolidate shipments, assume responsibility for the transportation from the place of receipt to the place of destination, and often issues bills of lading. See 49 U.S.C. § 131028).

Why the distinction matters: In a truck accident lawsuit against a broker, you generally argue that the broker had a duty to use reasonable care when selecting a safe carrier and that the broker’s conduct was a substantial factor in causing the crash. This is different from claims against the motor carrier, which often involve direct safety violations or driver negligence.

Can you sue the trucking broker for negligence?

Yes, you can sue a freight broker in some situations. The legal theories most often asserted are:

- Negligent hiring or negligent selection: The broker failed to vet the carrier reasonably, despite red flags in safety ratings, crash history, driver qualification issues, insurance problems, or regulatory violations.

- Negligent entrustment: The broker entrusted a load to a carrier it knew or should have known was unfit for the route, cargo, or required safety practices.

- Negligent undertaking: The broker went beyond arranging transportation by taking on safety-related tasks and performing them carelessly, increasing the risk of harm.

- Vicarious liability: In limited situations, a broker can be treated as the principal of the driver or carrier if the broker retained the right to control important details of the work, though this is typically disputed.

Whether these claims are allowed can depend on federal preemption under the FAAAA, discussed below, and on the specific facts of control, vetting, and communications. A trucking accident lawyer in Texas, California, or Illinois will evaluate broker contracts, dispatch instructions, safety protocols, and whether FMCSA data pointed to known risks.

What is negligent hiring or negligent selection by a broker?

Negligent selection focuses on what the broker knew or should have known about the carrier when assigning the load. Examples of potential red flags include:

- Unfit or conditional safety rating: If a carrier had an FMCSA “Unsatisfactory” or “Conditional” safety fitness rating, a broker that continued to use that carrier without additional safeguards may face scrutiny. FMCSA safety rating rules are part of 49 CFR Part 385.

- Poor safety data: Brokers often review public safety data, such as inspection and crash history. If the data shows a pattern of hours-of-service violations, out-of-service orders, or serious crashes, proceeding without further checks may be unreasonable.

- Insurance lapses: Federal law requires carriers to maintain minimum levels of financial responsibility. A broker should confirm current insurance coverage before tendering a load.

- Driver qualification problems: Carriers must maintain driver qualification files and perform background checks, including prior employer inquiries. See 49 CFR § 391.23 and § 391.51.

Courts have long recognized negligent selection claims against intermediaries who place the public at risk by choosing unsafe contractors. Whether a specific broker’s conduct was negligent is usually a fact question, making early evidence preservation critical.

Does federal law preempt broker-negligence claims?

Preemption is often the central defense. The Federal Aviation Administration Authorization Act of 1994, as amended, limits state laws related to the prices, routes, or services of motor carriers and brokers. The key statute is 49 U.S.C. § 14501c).

What does the FAAAA say, and what is the safety exception?

- General rule: A state may not enact or enforce a law, regulation, or other provision having the force and effect of law related to a motor carrier, broker, or freight forwarder’s prices, routes, or services. See 49 U.S.C. § 14501c)1).

- Safety exception: The preemption rule does not restrict a state’s safety regulatory authority over motor vehicles. See 49 U.S.C. § 14501c)2)A).

The question in broker cases is whether negligence claims are “related to” a broker’s “services,” and if so, whether they fall within the safety exception. Federal circuits have reached different conclusions, which directly affect residents in California and Illinois, and influences arguments in Texas cases.

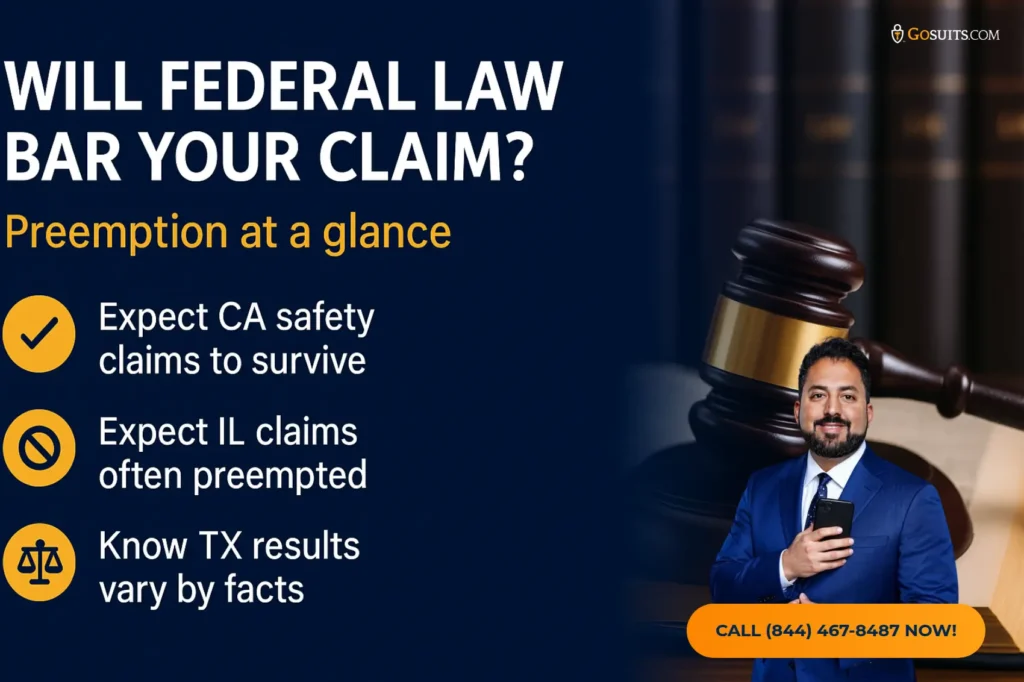

How have courts in California, Texas, and Illinois treated broker liability?

- California and the Ninth Circuit: In Miller v. C.H. Robinson Worldwide, Inc., 976 F.3d 1016 9th Cir. 2020), the court allowed a negligence claim against a broker to proceed, holding that the FAAAA’s safety exception can apply to common-law negligence claims arising from motor vehicle safety. For crashes occurring in California, federal courts often follow Miller, which means broker negligence claims may not be preempted when grounded in motor vehicle safety.

- Illinois and the Seventh Circuit: In Ye v. GlobalTranz Enterprises, Inc., the Seventh Circuit concluded that negligence claims against a broker for selection of a carrier were preempted by 49 U.S.C. § 14501c)1) and that the safety exception did not save the claim. This is significant for Chicago, Naperville, Springfield, and statewide Illinois cases because federal courts there often apply Ye to broker negligence claims.

- Texas and the Fifth Circuit: The Fifth Circuit has not issued a controlling opinion squarely resolving the question. District courts in Texas have reached differing outcomes depending on the facts and how they read the safety exception. Litigants in Houston, Dallas, Austin, and San Antonio should expect a detailed briefing on preemption, with careful attention to whether the claim truly regulates broker services or instead fits within motor vehicle safety.

- Eleventh Circuit cargo-loss cases: For context, the Eleventh Circuit has found FAAAA preemption for negligence claims against a broker in a cargo-theft dispute where the safety exception did not apply because no motor vehicle safety was at issue. See Aspen American Insurance Co. v. Landstar Ranger, Inc., 65 F.4th 1261 11th Cir. 2023).

The split means your forum matters. In California, a California truck accident attorney in Los Angeles, San Diego, San Jose, or San Francisco may rely on Miller. In Illinois, an Illinois truck accident lawyer in Chicago or Springfield will likely encounter Ye. In Texas, a Texas truck accident lawyer will tailor arguments to the Fifth Circuit and Texas law, highlighting safety-specific evidence and the narrow focus of your claims.

When can a broker be vicariously liable for a trucker’s negligence?

Vicarious liability depends on whether the broker had the right to control the details of the driver’s work, creating an agency relationship. It is uncommon, but possible in certain fact patterns. For example, Illinois courts have recognized vicarious liability claims when a broker exerted control over key aspects of the delivery beyond mere load tendering, such as setting strict dispatch rules and penalties that functioned like employer control. See Sperl v. C.H. Robinson Worldwide, Inc., 408 Ill. App. 3d 1051 2011). Brokers often counter that they only coordinate shipments and do not control how drivers operate vehicles. Contracts, emails, texts, load confirmations, and instructions can make the difference.

Which federal safety rules and records matter in a broker case?

Although brokers are not motor carriers, the safety rules governing carriers and drivers help frame what a reasonable broker would check when vetting a carrier:

- Definitions and scope: See 49 CFR § 390.5T for definitions of motor carrier, driver, and commercial motor vehicle.

- Driver qualification: Carriers must maintain driver qualification files and investigate prior employment and driving history. See 49 CFR § 391.23 and § 391.51.

- Hours of service and ELD data: Carriers must keep records of duty status, with ELD requirements and record retention typically at least six months. See 49 CFR § 395.8.

- Drug and alcohol testing records: Carriers must keep controlled substances and alcohol testing records for specified periods. See 49 CFR § 382.401.

- Broker records: Brokers must keep certain transaction records for a minimum period, usually three years, including load information. See 49 CFR § 371.3 and broker definitions in § 371.2.

- Broker registration and financial responsibility: Brokers must register and maintain a bond or trust commonly $75,000). See 49 U.S.C. § 13904 and § 13906.

In negligent selection cases, a plaintiff may argue that a reasonable broker would have reviewed FMCSA registration, safety ratings, insurance, public safety data, and any prior incidents with that carrier before assigning the load.

What records should be preserved, and how do you send a preservation letter?

After a serious crash, evidence can disappear quickly. A timely evidence preservation letter puts the broker and carrier on notice to keep relevant records. Federal courts may impose sanctions if electronically stored information is lost after a duty to preserve arises. See Federal Rule of Civil Procedure 37e).

Records to request in a preservation letter often include:

- Broker files: Carrier vetting records, internal safety policies, emails and texts about the load, load confirmations, rate confirmations, carrier compliance checklists, insurance verifications, and transaction records required by 49 CFR § 371.3.

- Carrier safety and driver files: Driver qualification file for the driver in the crash, prior employer inquiries, MVRs, training, and discipline. See 49 CFR § 391.23 and § 391.51.

- ELD and hours-of-service data: ELD logs, supporting documents, dispatch records, and GPS data. See 49 CFR § 395.8.

- Drug and alcohol testing: Post-accident testing records and the carrier’s testing program records. See 49 CFR § 382.401.

- Insurance and contracts: Certificates of insurance, broker-carrier agreements, shipper-broker contracts, and any special instructions for the shipment.

- Vehicle data: ECM downloads, pre- and post-trip inspection reports, and repair records.

A preservation letter should be sent quickly and addressed to the broker, carrier, and shipper if appropriate. It should identify the crash, the types of data to preserve, and reference the duty to preserve potentially relevant evidence for litigation.

What evidence proves or defeats broker negligence?

- Known safety red flags: Prior collisions, out-of-service orders, or a conditional safety rating known to the broker.

- Minimal or checkbox vetting: No documented review of FMCSA registration, insurance, or safety data before tendering the load.

- Rushed dispatch pressures: Emails or texts showing speed pressures that increased risk, such as unrealistic delivery windows encouraging hours-of-service violations.

- Prior incidents with the same carrier: Internal logs indicate the broker already had concerns about the carrier.

- Safety undertakings: Broker policies promising certain safety checks that were not followed.

What defenses do brokers raise, and how do defendants document them?

- FAAAA preemption: Arguing state negligence claims are preempted as relating to broker services under 49 U.S.C. § 14501c)1).

- Reasonable vetting: Showing documented checks of registration, insurance, safety rating, and public data for the carrier, and that no clear red flags existed.

- No control: Demonstrating the broker did not control driver hours, routing, or day-to-day operations, supporting no agency relationship.

- Intervening cause: Asserting the carrier’s independent negligence or third-party acts were the sole proximate cause.

- Comparative fault: Depending on the state, arguing that the plaintiff’s or other defendants’ fault reduces liability.

How do statutes of limitations work in TX, CA, and IL for broker claims?

Act quickly. Time limits are strict, and different rules apply if a governmental entity is involved.

- Texas: Generally two years for personal injury and wrongful death. See Tex. Civ. Prac. & Rem. Code § 16.003a) and § 16.003b). Notice to governmental units can be required within six months. See Tex. Civ. Prac. & Rem. Code § 101.101.

- California: Generally two years for personal injury and wrongful death. See Cal. Code Civ. Proc. § 335.1. If a public entity is involved, a government claim usually must be filed within six months. See Cal. Gov. Code § 911.2.

- Illinois: Generally two years for personal injury. See 735 ILCS 5/13-202. Wrongful death actions are generally two years. See 740 ILCS 180/2.

Special rules may toll, shorten, or extend deadlines, such as for minors or deceased persons. A local attorney near you can confirm the correct deadline for your specific facts in Houston, Dallas, Austin, San Antonio, Los Angeles, San Diego, San Jose, San Francisco, Chicago, Naperville, Springfield, and statewide cases.

How do damages and fault allocation work in these cases?

Civil truck crash cases seek compensation for medical bills, lost income, pain and suffering, loss of household services, and property damage. Families may also seek wrongful death damages and survival damages where available. Punitive damages are sometimes considered when the conduct shows conscious indifference to safety. Fault allocation varies by state:

- Texas: Modified comparative fault with a 51 percent bar. A plaintiff who is more than 50 percent at fault cannot recover, and damages are reduced by the plaintiff’s percentage of fault.

- California: Pure comparative fault. A plaintiff’s damages are reduced by their percentage of fault, no matter how high.

- Illinois: Modified comparative fault with a 51 percent bar. If the plaintiff is more than 50 percent at fault, recovery is barred.

In multi-defendant cases that include a broker, carrier, and possibly the shipper, the jury may apportion fault among them. Evidence of a broker’s vetting process and communications can affect that apportionment.

Can punitive damages apply against a broker?

Punitive damages are reserved for egregious conduct, such as knowingly using an unsafe carrier after clear warnings. Whether punitive damages are available and what must be proven depends on the state’s standards. Courts examine the broker’s internal safety policies, repeated violations, knowledge of an unfit carrier, and whether the broker ignored known risks.

What steps should you take after a crash involving a brokered load?

- Get medical care: Prompt treatment protects your health and documents injuries.

- Capture details: If possible, record the MC DOT numbers, broker name on paperwork, bill of lading, trailer number, and any load confirmation you can obtain.

- Secure counsel early: Broker cases turn on records held by others. An attorney can send preservation letters to the broker, carrier, and shipper, and can move for court orders if needed.

- Avoid discussing fault: Limit communications with insurers until you have representation.

- Track expenses: Keep medical bills, wage-loss documents, and out-of-pocket costs.

Early legal help is especially important in broker cases because brokers are not on scene, and their records can be deleted under ordinary retention schedules if not preserved.

How do contingency fee arrangements and costs typically work?

In many personal injury cases, attorneys offer contingency fee arrangements where legal fees are a percentage of the recovery, and you do not pay fees if there is no recovery. Case expenses such as expert evaluations, crash reconstruction, and ELD data analysis may be advanced and reimbursed from the recovery. Ask your attorney to explain the fee agreement, including costs, how liens are resolved, and how settlement decisions are made.

How does GoSuits help truck crash victims and families?

Truck crash cases with potential broker negligence move fast, and the records that matter are often in the hands of brokers and carriers. A free consultation with a personal injury attorney helps you understand deadlines, preservation steps, and the strategy for identifying every responsible party, including a freight broker if the facts support it.

GoSuits represents clients in Texas, California, and Illinois. Our team blends hands-on trial advocacy with a technology-driven approach that moves cases forward. We use exclusive proprietary software to collect, organize, and analyze data like ELD logs, telematics, and broker-carrier transactions faster, which can streamline discovery and strengthen case presentation.

Although we leverage advanced tools to expedite your case, every client has a designated attorney. We do not route clients through case managers. You have direct, unfettered access to your lawyer to discuss strategy, settlement, and trial readiness. Our attorneys bring 30 years of combined experience and have taken trucking cases to trial, which often improves negotiation posture and prepares your case for the courtroom if needed.

We have achieved strong results for clients across serious injury and wrongful death matters. You can review examples of past work at our prior cases page: GoSuits Prior Cases. Results depend on the facts and law in each case. Our practice covers truck and bus crashes, rideshare collisions, unsafe roadway claims, product defect cases, and other serious injury litigation. If your crash may involve a freight broker in Texas, California, or Illinois, we can evaluate the facts, the preemption landscape, and the best venue to pursue your claim.

References and resources

- 49 U.S.C. § 13102, definitions including broker, motor carrier, and freight forwarder: law.cornell.edu

- 49 U.S.C. § 14501c), preemption and safety exception: law.cornell.edu

- 49 U.S.C. § 13904, broker registration: law.cornell.edu

- 49 U.S.C. § 13906, financial responsibility including broker bond: law.cornell.edu

- 49 CFR § 371.2, broker definition; § 371.3, broker records: law.cornell.edu and law.cornell.edu

- 49 CFR § 390.5T, definitions for safety regulations: law.cornell.edu

- 49 CFR § 391.23, investigations and inquiries; § 391.51, driver qualification files: law.cornell.edu and law.cornell.edu

- 49 CFR § 395.8, driver’s record of duty status and retention: law.cornell.edu

- 49 CFR § 382.401, retention of drug and alcohol testing records: law.cornell.edu

- Federal Rule of Civil Procedure 37e), failure to preserve electronically stored information: law.cornell.edu

- FMCSA Large Truck and Bus Crash Facts 2021, national statistics: fmcsa.dot.gov

- Texas personal injury and wrongful death limitations, Tex. Civ. Prac. & Rem. Code § 16.003: statutes.capitol.texas.gov

- Texas notice to governmental unit, Tex. Civ. Prac. & Rem. Code § 101.101: statutes.capitol.texas.gov

- California personal injury limitations, Cal. Code Civ. Proc. § 335.1: leginfo.legislature.ca.gov

- California government claims deadline, Cal. Gov. Code § 911.2: leginfo.legislature.ca.gov

- Illinois personal injury limitations, 735 ILCS 5/13-202: ilga.gov

- Illinois wrongful death limitations, 740 ILCS 180/2: ilga.gov

- Miller v. C.H. Robinson Worldwide, Inc., 976 F.3d 1016 9th Cir. 2020) safety exception allowed negligence claim) and Sperl v. C.H. Robinson Worldwide, Inc., 408 Ill. App. 3d 1051 2011) broker vicarious liability considered), case citations provided for context.

- Ye v. GlobalTranz Enterprises, Inc., Seventh Circuit decision addressing FAAAA preemption of broker negligence claims, citation provided for context.

- Aspen American Insurance Co. v. Landstar Ranger, Inc., 65 F.4th 1261 11th Cir. 2023) FAAAA preemption in cargo-loss negligence claims), citation provided for context.

Frequently Asked Questions

Can you sue the company that hired a negligent trucker?

Yes, depending on the facts, you may sue the freight broker for negligent hiring, negligent selection, negligent entrustment, or in rare cases vicarious liability. Whether the claim is allowed can depend on federal preemption and your jurisdiction.

What is the difference between a freight broker and a carrier in liability terms?

Carriers operate trucks and are directly subject to FMCSA safety rules. Brokers arrange transportation and can be liable if they negligently select an unsafe carrier or take on and mishandle safety-related tasks.

Do FMCSA regulations require brokers to check safety data?

FMCSA rules directly regulate carriers and drivers. Brokers have recordkeeping and registration duties. Whether a reasonable broker must check certain safety data is evaluated under state negligence standards and the facts of the case.

What if the broker says federal law preempts my claim?

Courts are split. The Ninth Circuit allows safety-based negligence claims against brokers. The Seventh Circuit has held such claims are preempted. Your attorney will evaluate where your case can be filed and applicable precedent.

What is an evidence preservation letter and do I need one?

It is a notice telling the broker and carrier to preserve relevant records. It helps prevent loss of ELD data, vetting files, and communications. Federal Rule of Civil Procedure 37e) addresses sanctions for lost electronic evidence.

How long do I have to file?

Often two years in Texas, California, and Illinois, with exceptions and special notice rules for governmental entities. Always confirm the exact deadline for your facts.

Do I need a trucking accident lawyer near me?

Local counsel who handles trucking cases can quickly secure records, navigate state and federal courts, and coordinate with experts in Houston, Dallas, Austin, San Antonio, Los Angeles, San Diego, San Jose, San Francisco, Chicago, Naperville, Springfield, and statewide.