First-Party Residential Property Damage: What Every Homeowner Needs to Know

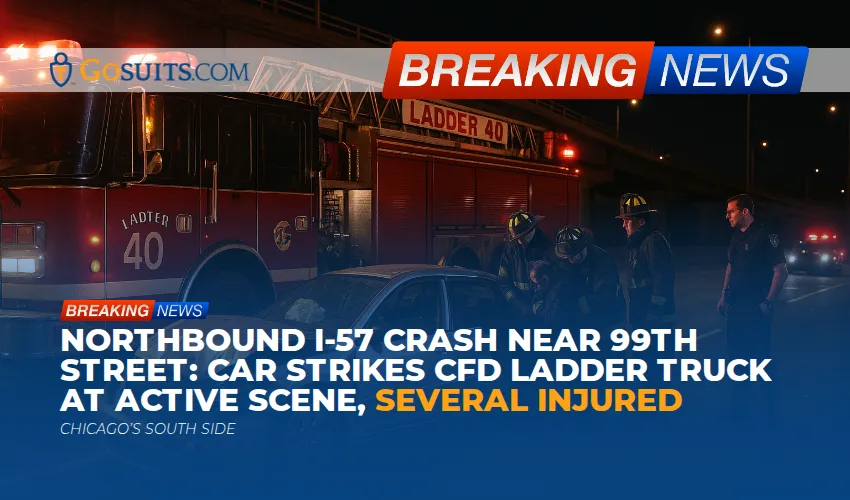

When disaster strikes your home, it can feel as though your entire life has been turned upside down. Whether it’s the aftermath of a fire, a destructive storm, or water damage, your home is more than just a building—it’s your safe haven. At a time when you’re at your most vulnerable, you count on your homeowners’ insurance to provide the protection you’ve paid for.

But what happens when your insurer makes the process difficult? When they deny your claim, underpay what’s needed to repair the damage, or delay payment altogether? Unfortunately, these challenges are all too common, leaving homeowners feeling frustrated and uncertain about their next steps.

First-party residential property damage claims are filed with your own insurance company for damages to your property caused by events like fires, windstorms, hail, or vandalism. Unlike third-party claims, where another party’s insurance is involved, first-party claims rely on the policy you hold with your insurer. This contractual relationship requires the insurer to uphold their obligations as outlined in the terms of your policy.

What Is Covered Under Homeowners Insurance?

While each policy is unique, there are common types of coverage that most policies provide. Understanding what is typically covered—and the limitations—can help you better prepare for unexpected situations.

Typical Coverage Areas

- Dwelling Coverage:

This portion of your policy protects the structure of your home, including the walls, roof, foundation, and built-in systems like plumbing and electrical wiring. Covered events typically include fire, windstorms, hail, lightning, and certain types of water damage. For example, if a tree falls on your roof during a storm or a fire destroys part of your home, the repairs or rebuilding costs may be covered under this section. - Other Structures:

Many policies also cover detached structures on your property, such as garages, sheds, fences, or guesthouses, if they are damaged by a covered peril. For instance, if a windstorm destroys a detached garage, your policy may cover the repair or replacement costs. - Personal Property Coverage:

This includes protection for your belongings, such as furniture, electronics, appliances, clothing, and personal valuables. If these items are damaged or destroyed by a covered peril or stolen during a burglary, your policy may reimburse you for their value. However, coverage limits may apply to certain high-value items like jewelry, art, or collectibles, so additional riders may be necessary for full protection. - Loss of Use or Additional Living Expenses (ALE):

If your home becomes uninhabitable due to a covered event, this coverage helps with temporary living expenses. For example, if a wildfire forces you to relocate, your policy may pay for hotel stays, meals, and other reasonable costs until repairs are complete. - Liability Protection:

Although not directly tied to property damage, liability coverage is a key component of most homeowners’ policies. It protects you against lawsuits or claims if someone is injured on your property or if you accidentally cause damage to someone else’s property.

Common Challenges Homeowners Face

Filing a first-party residential property damage claim can be a complicated and stressful process. Many homeowners encounter challenges that delay or reduce their ability to recover compensation for repairs. These challenges often include:

- Denial of Claims: Insurers may deny claims based on technicalities, such as alleged maintenance issues or exclusions in the policy. These denials often leave homeowners feeling frustrated and uncertain about their options, specifically when the damage appears to be clearly covered by their policy.

- Underpayment of Claims: Even when claims are approved, the amount offered may fall far short of the actual cost to repair or rebuild. Insurers often rely on low repair estimates or argue that partial repairs are sufficient when full replacements are needed, placing homeowners in difficult financial positions.

- Delays in Processing: Insurers may slow the process by requesting unnecessary documentation, failing to respond promptly, or delaying payments. These delays can leave homeowners waiting months to make critical repairs, all while dealing with the ongoing stress and disruption caused by the damage.

When faced with these challenges, having an attorney by your side can make a significant difference. While insurance companies have extensive resources and teams of adjusters working to minimize payouts, your attorney serves as your advocate, working to protect your rights and ensure you are treated fairly throughout the claims process.

Preventative Steps Homeowners Can Take

- Perform Regular Maintenance: Keeping your roof, plumbing, and other key systems in good condition can prevent damage that insurers may try to classify as neglect or wear and tear, which is often excluded from coverage.

- Maintain an Updated Home Inventory: Create a detailed list of your belongings, including receipts, serial numbers, and photographs. This documentation helps prove the value of your items in the event of theft, vandalism, or covered damage.

- Review Your Insurance Policy Regularly: Periodically reviewing your policy ensures you have adequate coverage, particularly after home improvements or acquiring valuable items. Consulting with an attorney can help identify gaps in coverage and clarify exclusions.

- Safeguard Key Documents: Store insurance policies, home inventories, and property photos in a secure, easily accessible location. Digital backups are particularly helpful to protect these records from being lost or damaged during emergencies.

- Seek Professional Guidance Before a Claim: Consulting an attorney about your policy or potential risks can help you prepare for unexpected property damage and strengthen your position if a claim becomes necessary.

Why Legal Representation Matters

Navigating a first-party residential property damage claim requires careful attention to detail and a strong understanding of insurance policies. This is where our firm comes in. We take pride in representing homeowners and advocating for their rights when they face challenges with their insurers.

At our firm, you’ll work directly with an attorney who will guide you through the claims process. Unlike larger firms that may assign your case to a case manager, we prioritize personalized attention and open communication. Our attorneys understand the complexities of these claims and are committed to helping you pursue the recovery you deserve.

We also use innovative strategies to manage claims efficiently and effectively. By combining legal proficiency with cutting-edge technology, we streamline the claims process and provide you with real-time updates on your case. This transparency ensures that you always know where your claim stands and what steps are being taken on your behalf.

In addition to providing legal guidance, our attorneys understand the importance of offering peace of mind during challenging times. Property damage can disrupt your life in significant ways, and having a trusted legal advocate can alleviate the stress of dealing with insurance disputes. Contact us to schedule a free consultation and explore how we may be able to assist with your claim.