California Commercial Property Damage Lawyers: Navigating First-Party Claims for Commercial Properties

If you’re a commercial property owner in California, dealing with property damage can be one of the most challenging experiences you face. When disasters strike, the financial and operational impacts on your business can be overwhelming. Navigating first-party property damage claims requires a clear understanding of your rights and the role your insurance policy plays. It’s not something you should go through alone. Our team of property damage lawyers is here to provide you with the guidance and advocacy you need to recover and rebuild.

What Are First-Party Property Damage Claims?

First-party property damage claims involve disputes between you, the policyholder, and your insurance company. Unlike third-party claims, which address damages caused to others, first-party claims focus exclusively on your own property and the terms of your insurance policy. For commercial property owners, these claims often arise from significant incidents such as fires, floods, or vandalism. When these events occur, your priority is to secure fair compensation to cover repairs, replacements, and other necessary expenses to get your business back on track.

The complexity of these claims lies in the insurance policy itself. Commercial policies are often detailed and filled with terms that can be difficult to interpret. Whether you’re dealing with a total loss of property or partial damage, understanding your rights under the policy is critical. That’s where working with a property damage lawyer can make a world of difference. We help you decode the fine print, identify the coverage you’re entitled to, and stand up for you when insurance companies push back.

Common Types of Commercial Property Damage

Commercial properties are exposed to a wide range of risks that differ from residential properties:

- Fires: Fires can cause extensive structural damage and destroy critical business assets, including equipment and inventory. The aftermath of a fire often requires significant reconstruction and investment.

- Water Damage: Incidents like plumbing failures, burst pipes, or flooding can ruin both the physical structure and contents of a commercial property, leading to costly repairs and replacements.

- Earthquakes: California’s seismic activity poses a constant threat to businesses, particularly in areas near fault lines. Structural damage from earthquakes can be devastating and often requires compliance with updated safety codes during rebuilding.

- Wildfires: Wildfires in California have destroyed thousands of businesses in recent years, leaving owners to navigate extensive damage claims while also coping with lost revenue and operations.

Handling Insurance for Commercial Property Damage

Dealing with insurance companies after your property has been damaged is rarely straightforward. While policies are designed to provide coverage, insurers may attempt to minimize payouts or deny claims altogether. This can be problematic when you’re trying to recover from an incident and need funds to repair or rebuild your business.

Your insurance policy is a contract that sets out the responsibilities of both parties. Unfortunately, these contracts often include technical language that can be hard to interpret. For example, terms like “replacement cost” and “actual cash value” can significantly impact the amount you’re eligible to receive. Additionally, policies frequently contain exclusions, which insurers may rely on to limit their liability. Understanding these nuances requires experience and attention to detail—qualities that a property damage lawyer brings to the table.

We take a proactive approach to handling insurance disputes. From filing your claim to negotiating with the insurance company, we ensure your rights are protected. If the insurer delays, undervalues, or denies your claim without justification, we’re prepared to escalate the matter and hold them accountable for acting in bad faith. Our goal is to secure the compensation you deserve so you can focus on your business without unnecessary stress.

Legal Rights of Policyholders in California

California’s laws are designed to protect policyholders from unfair treatment by insurance companies. The California Fair Claims Settlement Practices Act, for instance, establishes standards for how insurers must handle claims. These include timely communication, fair investigation of damages, and prompt payment of settlements. If your insurer fails to meet these obligations, they may be acting in bad faith.

Bad faith insurance practices can take many forms, from unreasonable delays to outright denials of valid claims. When this occurs, you have the right to challenge the insurer’s actions and seek remedies under the law.

Facts About California and Its Impact on Commercial Property Claims

California is a unique state when it comes to commercial property damage. Its diverse geography and climate mean that businesses face a wide range of risks. Recent calamities have highlighted these vulnerabilities. In this year alone, thousands of businesses have fallen victim to the Palisades Fire. In 2023, businesses in Southern California were heavily impacted by Tropical Storm Hilary, which caused widespread flooding and property damage. Northern California continues to recover from the devastating effects of the Camp Fire, which destroyed thousands of structures and disrupted countless businesses. Earthquakes, such as the Ridgecrest earthquakes of 2019, serve as reminders of the seismic risks that many areas face. Meanwhile, ongoing drought conditions worsen wildfire risks across the state.

Many areas, such as those near fault lines or in wildfire-prone regions, require specialized insurance coverage that isn’t included in standard policies. In addition, California’s strict building codes and environmental regulations can influence how damages are assessed and repaired. For example, rebuilding after a fire may involve compliance with updated safety standards, which can increase costs. These factors highlight the importance of working with a property damage lawyer who understands the state’s unique challenges and can advocate effectively on your behalf.

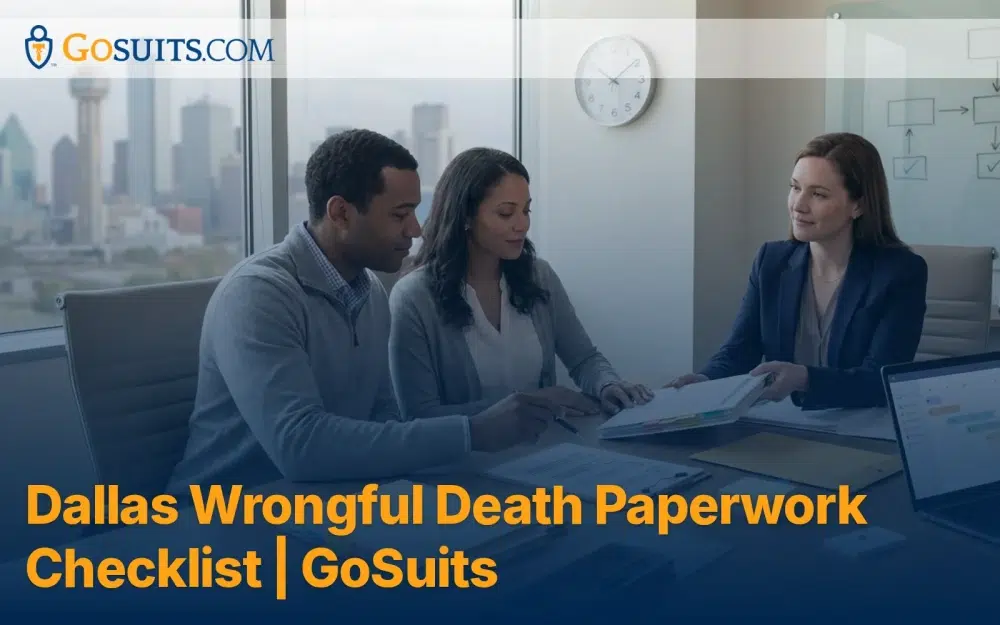

Work with Gosuits Trial Lawyers

At Gosuits, we pride ourselves on delivering personalized legal support that goes beyond the standard approach of larger firms. Unlike many practices that rely heavily on case managers, we ensure that you receive individualized attention from an attorney who will guide you through every step of your claim. From start to finish, your case will be handled by a dedicated professional who understands your needs and advocates for your best interests.

Our firm’s innovative use of technology sets us apart. We’ve implemented proprietary software that leverages machine learning to streamline certain aspects of legal practice. This not only expedites case management but also ensures accuracy and transparency. Clients have unrestricted access to their case files and can communicate directly with their attorneys at any time. This combination of human care and technological precision allows us to achieve superior outcomes for our clients.

We operate on a contingency fee basis, meaning we only get paid if we secure compensation for you. This structure reflects our confidence in our ability to deliver results and our commitment to making legal support accessible, even during financially challenging times. Over the years, we have successfully recovered compensation for hundreds of clients, and the glowing testimonials on our Google Business Page attest to our dedication and excellence.

When you choose Gosuits, you’re choosing a team that prioritizes your peace of mind and health throughout the legal process. We focus on modern, smart strategies rather than adversarial tactics, ensuring that we address your concerns with professionalism and compassion. Let us handle the complexities of your case while you focus on rebuilding and moving forward with confidence.