While insurance exists to provide coverage for accidents, the process of obtaining fair compensation is not always straightforward. Insurance companies operate as businesses, and their focus is on minimizing financial liability. This means they will carefully evaluate claims, review policy terms, and look for ways to reduce the amount they pay out.

In California, the at-fault driver’s insurance company is typically responsible for covering damages. However, establishing fault and determining the extent of damages is not always simple. Insurance adjusters may ask for statements, request records, and investigate the circumstances of the accident. Their goal is to find any reason to limit or deny a claim, whether by questioning the severity of injuries or arguing that their policyholder was not fully at fault. California follows a comparative negligence rule, meaning that if a person is found to be 50% or more responsible for an accident, they may not be able to recover damages. Insurance companies often use this to their advantage by attempting to shift blame.

Handling communications with insurance companies is an important part of the claims process. Every statement given to an adjuster can influence the outcome of a claim. A simple comment about not feeling injured immediately after the accident can later be used to downplay medical issues. This is why legal guidance is valuable in ensuring that the facts of the case are properly presented.

What Strategies Do Insurance Companies Use to Reduce Payouts?

Insurance companies use a variety of strategies to limit how much they pay for a claim. One of the most common approaches is offering a quick settlement soon after an accident. These initial offers may not reflect the full extent of a person’s injuries, medical needs, or long-term financial impact. Once a settlement is accepted, there is no opportunity to seek further compensation, even if additional medical treatment becomes necessary.

Another common tactic is delaying the claims process. Some insurers take longer than necessary to review records, request additional documentation multiple times, or require extensive paperwork before processing a claim. These delays can create financial pressure, making some individuals more likely to accept a lower settlement just to resolve the case.

Recorded statements are another tool insurance companies use to control the claims process. Adjusters may ask to record a conversation under the premise that it is part of routine procedures. However, recorded statements can later be scrutinized, with any inconsistencies or unclear phrasing used to challenge the claim. Managing these interactions carefully is key to avoiding complications in the claims process.

Common Insurance Company Tactics to Watch For

Insurance companies often take specific steps to limit payouts. Some of the most common tactics include:

- Quick, low settlement offers: Insurers may offer a settlement before the full extent of injuries and damages is known. These early offers often do not account for long-term medical needs, lost wages, or ongoing pain and suffering.

- Delaying claim processing: Requests for additional documentation, slow communication, and repeated delays can push accident victims to accept a lower settlement out of frustration.

- Shifting blame: Insurance companies may argue that the injured party was partially or fully responsible for the accident, reducing or eliminating their financial obligation.

- Minimizing injuries: Insurers frequently claim that injuries are not as severe as reported or that they stem from pre-existing conditions rather than the accident itself.

- Using recorded statements to their advantage: Any statement given to an insurance adjuster may be used to weaken a claim, even if it was made innocently or under stress.

How Is Communication with the At-Fault Driver’s Insurance Handled?

The at-fault driver’s insurance company may reach out to request information, review medical records, or discuss the details of the accident. While these conversations may seem routine, insurers are often looking for ways to dispute or limit claims. They may question whether injuries are as severe as reported or argue that pre-existing conditions played a role. They may also challenge the estimated cost of vehicle repairs, suggesting that certain damages were not directly caused by the accident.

Because these discussions directly impact the outcome of a claim, they should be handled carefully. Insurance companies will look for ways to use statements or medical records to reduce their financial responsibility. A personal injury attorney can help manage these interactions so that only relevant information is shared and that the claim is properly supported with evidence.

What Happens If an Insurance Company Denies a Claim?

Unfortunately, insurance companies may deny claims for a variety of reasons, including disputes over liability, lack of sufficient documentation, or arguments that injuries are not as severe as reported. Some claim denials are based on legitimate factors, while others may be a result of the insurer acting unfairly.

Bad faith insurance practices occur when an insurance company wrongfully denies a valid claim, unnecessarily delays processing, misrepresents policy terms, or fails to conduct a proper investigation. California law provides certain protections against these practices. When an insurer refuses to negotiate fairly, there may be legal options available to challenge the denial.

A denied claim does not necessarily mean the case is closed. There may be opportunities to appeal the decision, provide additional evidence, or take further action to pursue compensation. Having legal support in these situations can make a difference in how a claim is addressed.

How Can Legal Representation Help in Insurance Negotiations?

Insurance negotiations involve a variety of factors, including medical expenses, lost wages, vehicle damage, and pain and suffering. These claims are not always straightforward, and insurance companies often challenge different aspects of the case. Legal representation helps navigate these challenges by handling the complexities of the claims process and ensuring that accident victims are not pressured into accepting settlements that do not reflect the true impact of their injuries.

Attorneys take on many responsibilities in insurance negotiations, including:

- Communicating with insurance adjusters: This helps prevent any misinterpretation of statements and ensures that all communications are handled properly.

- Reviewing settlement offers: Insurance companies may offer settlements that do not fully account for medical bills, future treatment, or financial losses. Legal representation helps evaluate these offers.

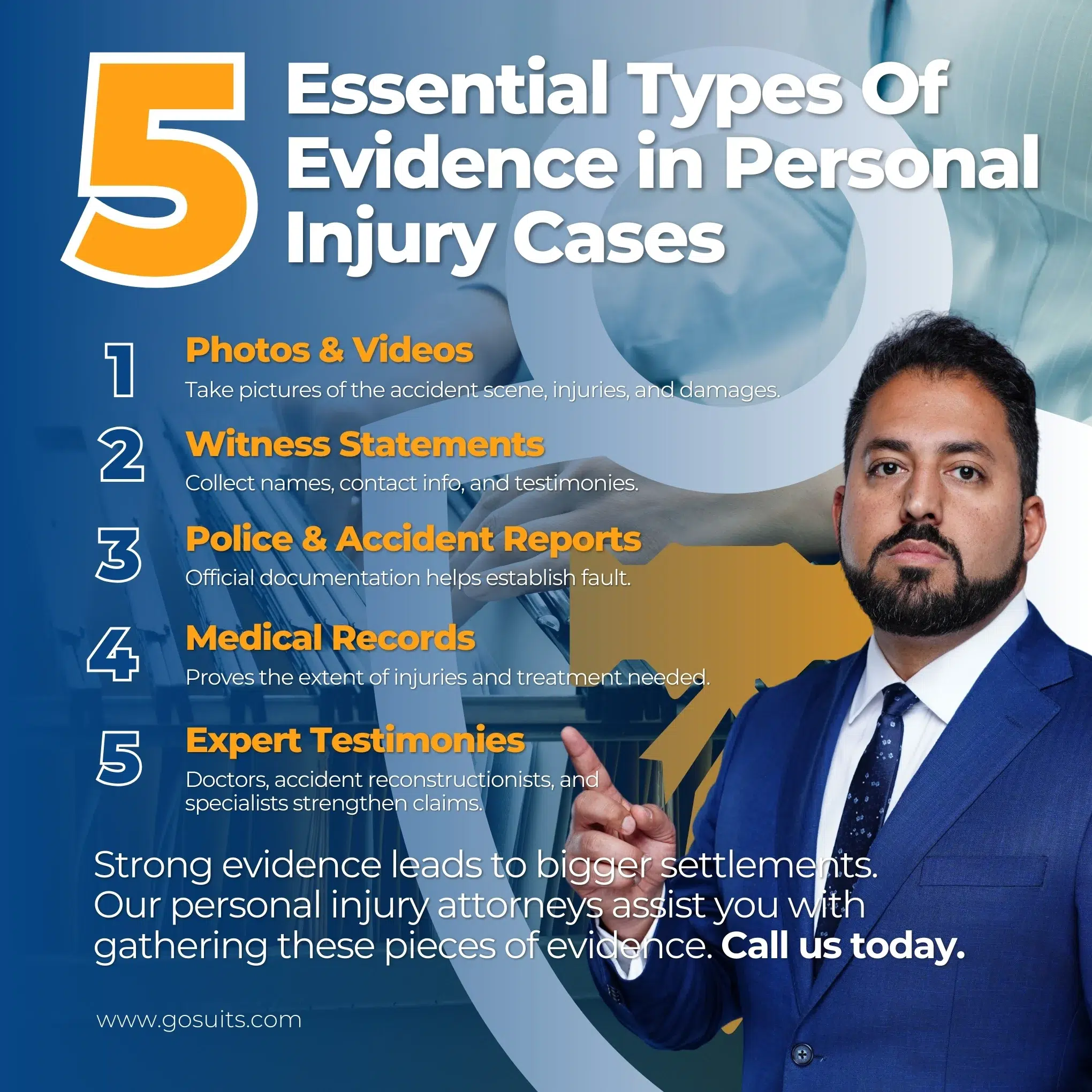

- Gathering evidence: Medical records, accident reports, and other forms of documentation are crucial in supporting a claim. Attorneys handle the process of collecting and presenting this information.

- Challenging claim denials: If an insurance company refuses to pay a valid claim, legal action may be necessary to dispute the decision and seek fair compensation.

Navigating an insurance claim after an accident isn’t just about paperwork and policies—it’s about making sure you’re treated fairly while you focus on healing. Insurance companies have teams of professionals looking out for their bottom line, and the process can feel overwhelming when you’re the one dealing with the aftermath of an accident. Having the right legal support means you don’t have to take on that fight alone. It means having someone who understands the system, pushes back against unfair tactics, and makes sure your needs aren’t overlooked.